Page 227 - DCOM507_STOCK_MARKET_OPERATIONS

P. 227

Stock Market Operations

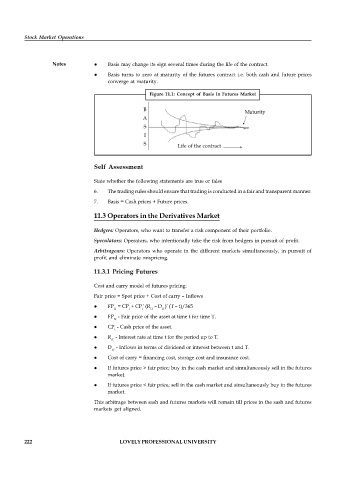

Notes Basis may change its sign several times during the life of the contract.

Basis turns to zero at maturity of the futures contract i.e. both cash and future prices

converge at maturity.

Figure 11.1: Concept of Basis in Futures Market

B

Maturity

A

S

I

S

Life of the contract

Self Assessment

State whether the following statements are true or false

6. The trading rules should ensure that trading is conducted in a fair and transparent manner.

7. Basis = Cash prices + Future prices.

11.3 Operators in the Derivatives Market

Hedgers: Operators, who want to transfer a risk component of their portfolio.

Speculators: Operators, who intentionally take the risk from hedgers in pursuit of profit.

Arbitrageurs: Operators who operate in the different markets simultaneously, in pursuit of

profit and eliminate mispricing.

11.3.1 Pricing Futures

Cost and carry model of futures pricing:

Fair price = Spot price + Cost of carry – Inflows

*

*

FP = CP + CP (R – D ) (T – t)/365

tT t t tT tT

FP - Fair price of the asset at time t for time T.

tT

CP - Cash price of the asset.

t

R - Interest rate at time t for the period up to T.

tT

D - Inflows in terms of dividend or interest between t and T.

tT

Cost of carry = financing cost, storage cost and insurance cost.

If futures price > fair price; buy in the cash market and simultaneously sell in the futures

market.

If futures price < fair price; sell in the cash market and simultaneously buy in the futures

market.

This arbitrage between sash and futures markets will remain till prices in the sash and futures

markets get aligned.

222 LOVELY PROFESSIONAL UNIVERSITY