Page 131 - DCOM508_CORPORATE_TAX_PLANNING

P. 131

Corporate Tax Planning

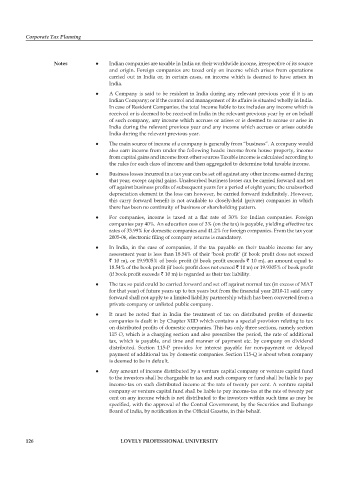

Notes Indian companies are taxable in India on their worldwide income, irrespective of its source

and origin. Foreign companies are taxed only on income which arises from operations

carried out in India or, in certain cases, on income which is deemed to have arisen in

India.

A Company is said to be resident in India during any relevant previous year if it is an

Indian Company; or if the control and management of its affairs is situated wholly in India.

In case of Resident Companies, the total income liable to tax includes any income which is

received or is deemed to be received in India in the relevant previous year by or on behalf

of such company, any income which accrues or arises or is deemed to accrue or arise in

India during the relevant previous year and any income which accrues or arises outside

India during the relevant previous year.

The main source of income of a company is generally from “business”. A company would

also earn income from under the following heads: income from house property, income

from capital gains and income from other sources Taxable income is calculated according to

the rules for each class of income and then aggregated to determine total taxable income.

Business losses incurred in a tax year can be set off against any other income earned during

that year, except capital gains. Unabsorbed business losses can be carried forward and set

off against business profits of subsequent years for a period of eight years; the unabsorbed

depreciation element in the loss can however, be carried forward indefi nitely. However,

this carry forward benefit is not available to closely-held (private) companies in which

there has been no continuity of business or shareholding pattern.

For companies, income is taxed at a flat rate of 30% for Indian companies. Foreign

companies pay 40%. An education cess of 3% (on the tax) is payable, yielding effective tax

rates of 33.99% for domestic companies and 41.2% for foreign companies. From the tax year

2005-06, electronic filing of company returns is mandatory.

In India, in the case of companies, if the tax payable on their taxable income for any

assessment year is less than 18.54% of their ‘book profit’ (if book profit does not exceed

` 10 m), or 19.9305% of book profit (if book profi t exceeds ` 10 m), an amount equal to

18.54% of the book profit (if book profit does not exceed ` 10 m) or 19.9305% of book profi t

(if book profi t exceeds ` 10 m) is regarded as their tax liability.

The tax so paid could be carried forward and set off against normal tax (in excess of MAT

for that year) of future years up to ten years but from the financial year 2010-11 said carry

forward shall not apply to a limited liability partnership which has been converted from a

private company or unlisted public company.

It must be noted that in India the treatment of tax on distributed profits of domestic

companies is dealt in by Chapter XIID which contains a special provision relating to tax

on distributed profits of domestic companies. This has only three sections, namely section

115 O, which is a charging section and also prescribes the period, the rate of additional

tax, which is payable, and time and manner of payment etc. by company on dividend

distributed. Section 115-P provides for interest payable for non-payment or delayed

payment of additional tax by domestic companies. Section 115-Q is about when company

is deemed to be in default.

Any amount of income distributed by a venture capital company or venture capital fund

to the investors shall be chargeable to tax and such company or fund shall be liable to pay

income-tax on such distributed income at the rate of twenty per cent. A venture capital

company or venture capital fund shall be liable to pay income-tax at the rate of twenty per

cent on any income which is not distributed to the investors within such time as may be

specified, with the approval of the Central Government, by the Securities and Exchange

Board of India, by notification in the Official Gazette, in this behalf.

126 LOVELY PROFESSIONAL UNIVERSITY