Page 16 - DCOM508_CORPORATE_TAX_PLANNING

P. 16

Unit 1: Income Tax: Basic Framework

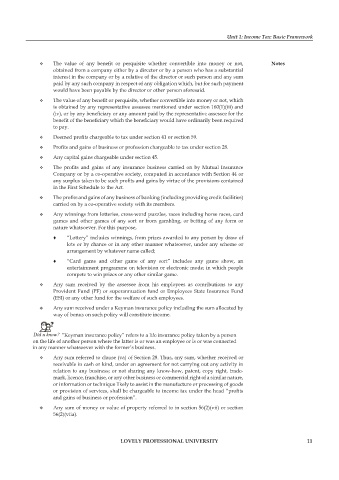

The value of any benefit or perquisite whether convertible into money or not, Notes

obtained from a company either by a director or by a person who has a substantial

interest in the company or by a relative of the director or such person and any sum

paid by any such company in respect of any obligation which, but for such payment

would have been payable by the director or other person aforesaid.

The value of any benefit or perquisite, whether convertible into money or not, which

is obtained by any representative assessee mentioned under section 160(1)(iii) and

(iv), or by any beneficiary or any amount paid by the representative assessee for the

benefit of the beneficiary which the beneficiary would have ordinarily been required

to pay.

Deemed profits chargeable to tax under section 41 or section 59.

Profits and gains of business or profession chargeable to tax under section 28.

Any capital gains chargeable under section 45.

The profits and gains of any insurance business carried on by Mutual Insurance

Company or by a co-operative society, computed in accordance with Section 44 or

any surplus taken to be such profits and gains by virtue of the provisions contained

in the First Schedule to the Act.

The profits and gains of any business of banking (including providing credit facilities)

carried on by a co-operative society with its members.

Any winnings from lotteries, cross-word puzzles, races including horse races, card

games and other games of any sort or from gambling, or betting of any form or

nature whatsoever. For this purpose,

“Lottery” includes winnings, from prizes awarded to any person by draw of

lots or by chance or in any other manner whatsoever, under any scheme or

arrangement by whatever name called;

“Card game and other game of any sort” includes any game show, an

entertainment programme on television or electronic mode; in which people

compete to win prizes or any other similar game.

Any sum received by the assessee from his employees as contributions to any

Provident Fund (PF) or superannuation fund or Employees State Insurance Fund

(ESI) or any other fund for the welfare of such employees.

Any sum received under a Keyman insurance policy including the sum allocated by

way of bonus on such policy will constitute income.

Did u know? “Keyman insurance policy” refers to a life insurance policy taken by a person

on the life of another person where the latter is or was an employee or is or was connected

in any manner whatsoever with the former’s business.

Any sum referred to clause (va) of Section 28. Thus, any sum, whether received or

receivable in cash or kind, under an agreement for not carrying out any activity in

relation to any business; or not sharing any know-how, patent, copy right, trade-

mark, licence, franchise, or any other business or commercial right of a similar nature,

or information or technique likely to assist in the manufacture or processing of goods

or provision of services, shall be chargeable to income tax under the head “profi ts

and gains of business or profession”.

Any sum of money or value of property referred to in section 56(2)(vii) or section

56(2)(viia).

LOVELY PROFESSIONAL UNIVERSITY 11