Page 179 - DCOM508_CORPORATE_TAX_PLANNING

P. 179

Corporate Tax Planning

Notes Telecom undertakings: Any undertaking providing telecommunication services, whether basic

or cellular, including radio paging, domestic satellite service or network of trunking (NOT),

broadband network and internet services on or after 1st April, 1995 but on or before 31st March,

2005.

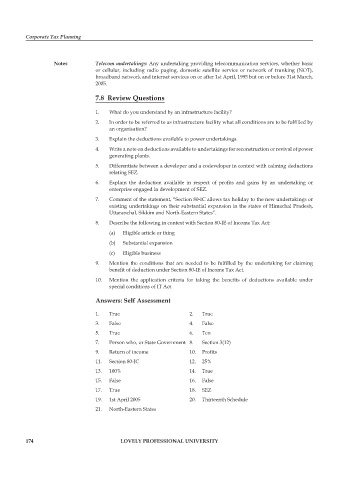

7.8 Review Questions

1. What do you understand by an infrastructure facility?

2. In order to be referred to as infrastructure facility what all conditions are to be fulfi lled by

an organisation?

3. Explain the deductions available to power undertakings.

4. Write a note on deductions available to undertakings for reconstruction or revival of power

generating plants.

5. Differentiate between a developer and a codeveloper in context with calming deductions

relating SEZ.

6. Explain the deduction available in respect of profits and gains by an undertaking or

enterprise engaged in development of SEZ.

7. Comment of the statement, “Section 80-IC allows tax holiday to the new undertakings or

existing undertakings on their substantial expansion in the states of Himachal Pradesh,

Uttaranchal, Sikkim and North-Eastern States”.

8. Describe the following in context with Section 80-IE of Income Tax Act:

(a) Eligible article or thing

(b) Substantial expansion

(c) Eligible business

9. Mention the conditions that are needed to be fulfilled by the undertaking for claiming

benefit of deduction under Section 80-IE of Income Tax Act.

10. Mention the application criteria for taking the benefits of deductions available under

special conditions of IT Act.

Answers: Self Assessment

1. True 2. True

3. False 4. False

5. True 6. Ten

7. Person who, or State Government 8. Section 3(12)

9. Return of income 10. Profi ts

11. Section 80-IC 12. 25%

13. 100% 14. True

15. False 16. False

17. True 18. SEZ

19. 1st April 2005 20. Thirteenth Schedule

21. North-Eastern States

174 LOVELY PROFESSIONAL UNIVERSITY