Page 23 - DCOM508_CORPORATE_TAX_PLANNING

P. 23

Corporate Tax Planning

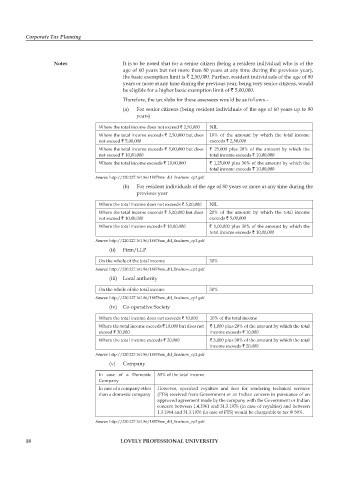

Notes It is to be noted that for a senior citizen (being a resident individual who is of the

age of 60 years but not more than 80 years at any time during the previous year),

the basic exemption limit is ` 2,50,000. Further, resident individuals of the age of 80

years or more at any time during the previous year, being very senior citizens, would

be eligible for a higher basic exemption limit of ` 5,00,000.

Therefore, the tax slabs for these assessees would be as follows –

(a) For senior citizens (being resident individuals of the age of 60 years up to 80

years)

Where the total income does not exceed ` 2,50,000 NIL

Where the total income exceeds ` 2,50,000 but does 10% of the amount by which the total income

not exceed ` 5,00,000 exceeds ` 2,50,000

Where the total income exceeds ` 5,00,000 but does ` 25,000 plus 20% of the amount by which the

not exceed ` 10,00,000 total income exceeds ` 10,00,000

Where the total income exceeds ` 10,00,000 ` 1,25,000 plus 30% of the amount by which the

total income exceeds ` 10,00,000

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

(b) For resident individuals of the age of 80 years or more at any time during the

previous year

Where the total income does not exceeds ` 5,00,000 NIL

Where the total income exceeds ` 5,00,000 but does 20% of the amount by which the total income

not exceed ` 10,00,000 exceeds ` 5,00,000

Where the total income exceeds ` 10,00,000 ` 1,00,000 plus 30% of the amount by which the

total income exceeds ` 10,00,000

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

(ii) Firm/LLP

On the whole of the total income 30%

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

(iii) Local authority

On the whole of the total income 30%

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

(iv) Co-operative Society

Where the total income does not exceeds ` 10,000 10% of the total income

Where the total income exceeds ` 10,000 but does not ` 1,000 plus 20% of the amount by which the total

exceed ` 20,000 income exceeds ` 10,000

Where the total income exceeds ` 20,000 ` 3,000 plus 30% of the amount by which the total

income exceeds ` 20,000

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

(v) Company

In case of a Domestic 30% of the total income

Company

In case of a company other However, specified royalties and fees for rendering technical services

than a domestic company (FTS) received from Government or an Indian concern in pursuance of an

approved agreement made by the company with the Government or Indian

concern between 1.4.1961 and 31.3.1976 (in case of royalties) and between

1.3.1964 and 31.3.1976 (in case of FTS) would be chargeable to tax @ 50%.

Source: http://220.227.161.86/18878sm_dtl_fi nalnew_cp1.pdf

18 LOVELY PROFESSIONAL UNIVERSITY