Page 254 - DCOM508_CORPORATE_TAX_PLANNING

P. 254

Unit 10: Tax Consideration in Specific Managerial Decisions

5. Housing/Education Loans. Notes

6. Charity/Religious trusts.

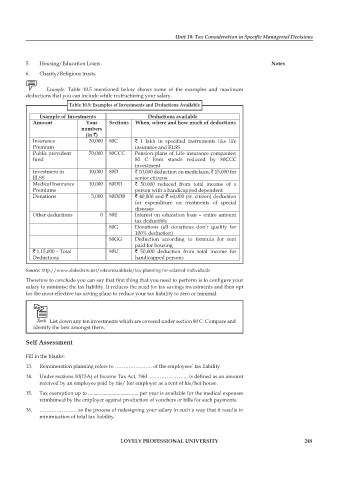

Example: Table 10.5 mentioned below shows some of the examples and maximum

deductions that you can include while restructuring your salary.

Table 10.5: Examples of Investments and Deductions Available

Example of Investments Deductions available

Amount Your Sections When, where and how much of deductions

numbers

(in `)

Insurance 20,000 80C ` 1 lakh in specified instruments like life

Premium insurance and ELSS

Public provident 70,000 80CCC Pension plans of Life insurance companies;

fund 80 C limit stands reduced by 80CCC

investment

Investment in 10,000 80D ` 10,000 deduction on mediclaim, ` 15,000 for

ELSS senior citizens

Medical Insurance 10,000 80DD ` 50,000 reduced from total income of a

Premiums person with a handicapped dependent

Donations 5,000 80DDB ` 40,000 and ` 60,000 (sr. citizen) deduction

for expenditure on treatments of special

diseases

Other deductions 0 80E Interest on education loan – entire amount

tax deductible

80G Donations (all donations don’t qualify for

100% deduction)

80GG Deduction according to formula for rent

paid for housing

` 1,15,000 – Total 80U ` 50,000 deduction from total income for

Deductions handicapped persons

Source: http://www.slideshare.net/vikramsankhala/tax-planning-for-salaried-individuals

Therefore to conclude you can say that first thing that you need to perform is to confi gure your

salary to minimise the tax liability. It reduces the need for tax savings investments and then opt

for the most effective tax saving plans to reduce your tax liability to zero or minimal.

Task List down any ten investments which are covered under section 80 C. Compare and

identify the best amongst them.

Self Assessment

Fill in the blanks:

13. Remuneration planning refers to …………………. of the employees’ tax liability.

14. Under sections 10(13A) of Income Tax Act, 1961 ………………….. is defined as an amount

received by an employee paid by his/ her employer as a rent of his/her house.

15. Tax exemption up to ....................................... per year is available for the medical expenses

reimbursed by the employer against production of vouchers or bills for such payments.

16. …………………. as the process of redesigning your salary in such a way that it results in

minimisation of total tax liability.

LOVELY PROFESSIONAL UNIVERSITY 249