Page 32 - DCOM508_CORPORATE_TAX_PLANNING

P. 32

Unit 2: Residential Status and Taxation

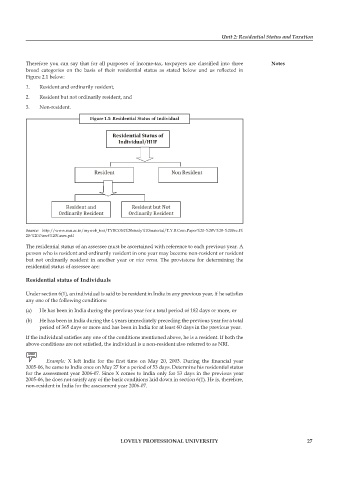

Therefore you can say that for all purposes of income-tax, taxpayers are classified into three Notes

broad categories on the basis of their residential status as stated below and as refl ected in

Figure 2.1 below:

1. Resident and ordinarily resident,

2. Resident but not ordinarily resident, and

3. Non-resident.

Figure 1.1: Residential Status of Individual

Source: http://www.mu.ac.in/myweb_test/TYBCOM%20study%20material/T.Y.B.Com.Paper%20-%20V%20-%20Sec.I%

20-%20Direct%20Taxes.pdf

The residential status of an assessee must be ascertained with reference to each previous year. A

person who is resident and ordinarily resident in one year may become non-resident or resident

but not ordinarily resident in another year or vice versa. The provisions for determining the

residential status of assessee are:

Residential status of Individuals

Under section 6(1), an individual is said to be resident in India in any previous year, if he satisfi es

any one of the following conditions:

(a) He has been in India during the previous year for a total period of 182 days or more, or

(b) He has been in India during the 4 years immediately preceding the previous year for a total

period of 365 days or more and has been in India for at least 60 days in the previous year.

If the individual satisfies any one of the conditions mentioned above, he is a resident. If both the

above conditions are not satisfied, the individual is a non-resident also referred to as NRI.

Example: X left India for the first time on May 20, 2003. During the fi nancial year

2005-06, he came to India once on May 27 for a period of 53 days. Determine his residential status

for the assessment year 2006-07. Since X comes to India only for 53 days in the previous year

2005-06, he does not satisfy any of the basic conditions laid down in section 6(1). He is, therefore,

non-resident in India for the assessment year 2006-07.

LOVELY PROFESSIONAL UNIVERSITY 27