Page 39 - DCOM508_CORPORATE_TAX_PLANNING

P. 39

Corporate Tax Planning

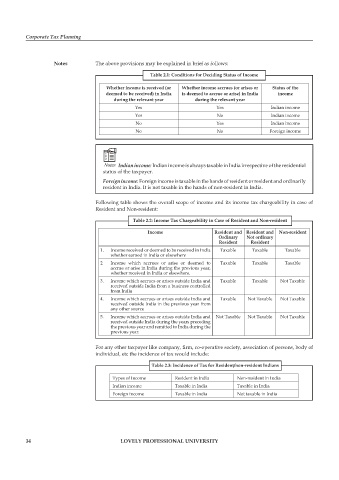

Notes The above provisions may be explained in brief as follows:

Table 2.1: Conditions for Deciding Status of Income

Whether income is received (or Whether income accrues (or arises or Status of the

deemed to be received) in India is deemed to accrue or arise) in India income

during the relevant year during the relevant year

Yes Yes Indian income

Yes No Indian income

No Yes Indian income

No No Foreign income

Notes Indian income: Indian income is always taxable in India irrespective of the residential

status of the taxpayer.

Foreign income: Foreign income is taxable in the hands of resident or resident and ordinarily

resident in India. It is not taxable in the hands of non-resident in India.

Following table shows the overall scope of income and its income tax chargeability in case of

Resident and Non-resident:

Table 2.2: Income Tax Chargeability in Case of Resident and Non-resident

Income Resident and Resident and Non-resident

Ordinary Not ordinary

Resident Resident

1. Income received or deemed to be received in India Taxable Taxable Taxable

whether earned in India or elsewhere

2 Income which accrues or arise or deemed to Taxable Taxable Taxable

accrue or arise in India during the previous year,

whether received in India or elsewhere.

3. Income which accrues or arises outside India and Taxable Taxable Not Taxable

received outside India from a business controlled

from India

4. Income which accrues or arises outside India and Taxable Not Taxable Not Taxable

received outside India in the previous year from

any other source

5. Income which accrues or arises outside India and Not Taxable Not Taxable Not Taxable

received outside India during the years preceding

the previous year and remitted to India during the

previous year.

For any other taxpayer like company, firm, co-operative society, association of persons, body of

individual, etc the incidence of tax would include:

Table 2.3: Incidence of Tax for Resident/non-resident Indians

Types of Income Resident in India Non-resident in India

Indian income Taxable in India Taxable in India

Foreign income Taxable in India Not taxable in India

34 LOVELY PROFESSIONAL UNIVERSITY