Page 88 - DCOM508_CORPORATE_TAX_PLANNING

P. 88

Unit 4: Set-off and Carry Forward of Losses

Thus, short-term capital loss is allowed to be set off against both short-term capital Notes

gain and long-term capital gain. However, long-term capital loss can be set-off only

against long-term capital gain and not short-term capital gain.

2. Speculation loss: A loss in speculation business can be set-off only against the profi ts of

any other speculation business and not against any other business or professional income.

However, losses from other business can be adjusted against profits from speculation

business.

3. Loss from the activity of owning and maintaining race horses: See section 74A (3) deals with

treatment of set-off of losses from the activity of owning and maintaining race horses.

!

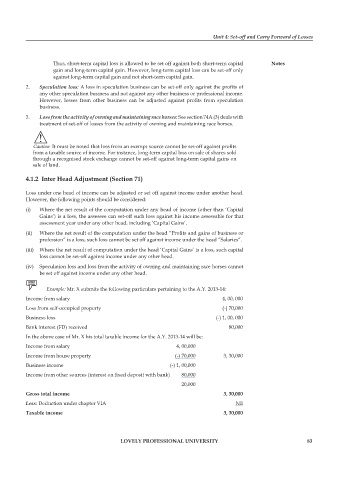

Caution It must be noted that loss from an exempt source cannot be set-off against profi ts

from a taxable source of income. For instance, long-term capital loss on sale of shares sold

through a recognised stock exchange cannot be set-off against long-term capital gains on

sale of land.

4.1.2 Inter Head Adjustment (Section 71)

Loss under one head of income can be adjusted or set off against income under another head.

However, the following points should be considered:

(i) Where the net result of the computation under any head of income (other than ‘Capital

Gains’) is a loss, the assessee can set-off such loss against his income assessable for that

assessment year under any other head, including ‘Capital Gains’.

(ii) Where the net result of the computation under the head “Profits and gains of business or

profession” is a loss, such loss cannot be set off against income under the head “Salaries”.

(iii) Where the net result of computation under the head ‘Capital Gains’ is a loss, such capital

loss cannot be set-off against income under any other head.

(iv) Speculation loss and loss from the activity of owning and maintaining race horses cannot

be set off against income under any other head.

Example: Mr. X submits the following particulars pertaining to the A.Y. 2013-14:

Income from salary 4, 00, 000

Loss from self-occupied property (-) 70,000

Business loss (-) 1, 00, 000

Bank interest (FD) received 80,000

In the above case of Mr. X his total taxable income for the A.Y. 2013-14 will be:

Income from salary 4, 00,000

Income from house property (-) 70,000 3, 30,000

Business income (-) 1, 00,000

Income from other sources (interest on fixed deposit with bank) 80,000

20,000

Gross total income 3, 30,000

Less: Deduction under chapter VIA Nil

Taxable income 3, 30,000

LOVELY PROFESSIONAL UNIVERSITY 83