Page 137 - DCOM510_FINANCIAL_DERIVATIVES

P. 137

Underlying index S&P CNX Nifty

Exchange of trading National Stock Exchange of India Limited

Financial Derivatives Security descriptor OPTIDX

Contract size Permitted lot size shall be 50

(minimum value ` 2 lakh)

Price steps ` 0.05

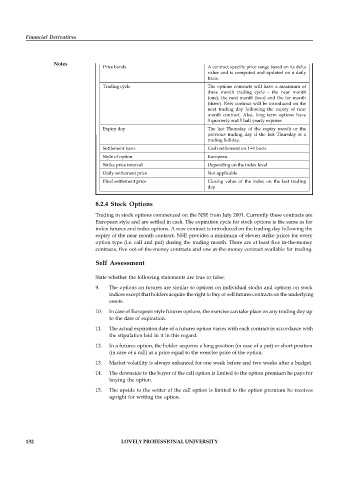

Notes

Price bands A contract specific price range based on its delta

value and is computed and updated on a daily

basis.

Trading cycle The options contracts will have a maximum of

three month trading cycle - the near month

(one), the next month (two) and the far month

(three). New contract will be introduced on the

next trading day following the expiry of near

month contract. Also, long term options have

3 quarterly and 5 half yearly expiries

Expiry day The last Thursday of the expiry month or the

previous trading day if the last Thursday is a

trading holiday.

Settlement basis Cash settlement on T+1 basis.

Style of option European.

Strike price interval Depending on the index level

Daily settlement price Not applicable

Final settlement price Closing value of the index on the last trading

day.

8.2.4 Stock Options

Trading in stock options commenced on the NSE from July 2001. Currently these contracts are

European style and are settled in cash. The expiration cycle for stock options is the same as for

index futures and index options. A new contract is introduced on the trading day following the

expiry of the near month contract. NSE provides a minimum of eleven strike prices for every

option type (i.e. call and put) during the trading month. There are at least five in-the-money

contracts, five out-of-the-money contracts and one at-the-money contract available for trading.

Self Assessment

State whether the following statements are true or false:

9. The options on futures are similar to options on individual stocks and options on stock

indices except that holders acquire the right to buy or sell futures contracts on the underlying

assets.

10. In case of European style futures options, the exercise can take place on any trading day up

to the date of expiration.

11. The actual expiration date of a futures option varies with each contract in accordance with

the stipulation laid in it in this regard.

12. In a futures option, the holder acquires a long position (in case of a put) or short position

(in case of a call) at a price equal to the exercise price of the option.

13. Market volatility is always enhanced for one week before and two weeks after a budget.

14. The downside to the buyer of the call option is limited to the option premium he pays for

buying the option.

15. The upside to the writer of the call option is limited to the option premium he receives

upright for writing the option.

132 LOVELY PROFESSIONAL UNIVERSITY