Page 199 - DCOM510_FINANCIAL_DERIVATIVES

P. 199

Financial Derivatives

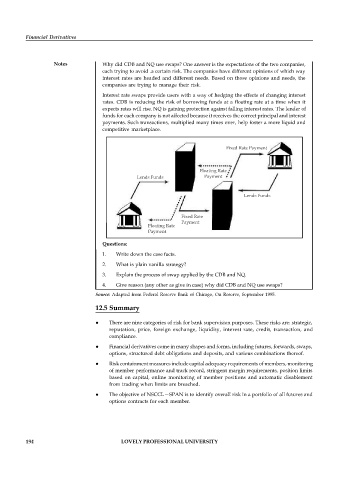

Notes Why did CDB and NQ use swaps? One answer is the expectations of the two companies,

each trying to avoid .a certain risk. The companies have different opinions of which way

interest rates are headed and different needs. Based on those opinions and needs, the

companies are trying to manage their risk.

Interest rate swaps provide users with a way of hedging the effects of changing interest

rates. CDB is reducing the risk of borrowing funds at a floating rate at a time when it

expects rates will rise. NQ is gaining protection against falling interest rates. The lender of

funds for each company is not affected because it receives the correct principal and interest

payments. Such transactions, multiplied many times over, help foster a more liquid and

competitive marketplace.

Fixed Rate Payment

Floating Rate

Lends Funds Payment

Lends Funds

Fixed Rate

Payment

Floating Rate

Payment

Questions:

1. Write down the case facts.

2. What is plain vanilla strategy?

3. Explain the process of swap applied by the CDB and NQ.

4. Give reason (any other as give in case) why did CDB and NQ use swaps?

Source: Adapted from Federal Reserve Bank of Chicago, On Reserve, September 1995.

12.5 Summary

There are nine categories of risk for bank supervision purposes. These risks are: strategic,

reputation, price, foreign exchange, liquidity, interest rate, credit, transaction, and

compliance.

Financial derivatives come in many shapes and forms, including futures, forwards, swaps,

options, structured debt obligations and deposits, and various combinations thereof.

Risk containment measures include capital adequacy requirements of members, monitoring

of member performance and track record, stringent margin requirements, position limits

based on capital, online monitoring of member positions and automatic disablement

from trading when limits are breached.

The objective of NSCCL—SPAN is to identify overall risk in a portfolio of all futures and

options contracts for each member.

194 LOVELY PROFESSIONAL UNIVERSITY