Page 207 - DCOM510_FINANCIAL_DERIVATIVES

P. 207

Financial Derivatives

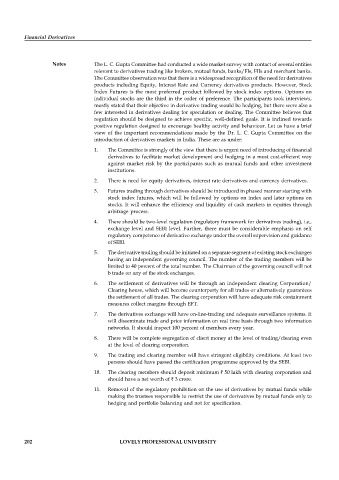

Notes The L. C. Gupta Committee had conducted a wide market survey with contact of several entities

relevant to derivatives trading like brokers, mutual funds, banks/FIs, FIIs and merchant banks.

The Committee observation was that there is a widespread recognition of the need for derivatives

products including Equity, Interest Rate and Currency derivatives products. However, Stock

Index Futures is the most preferred product followed by stock index options. Options on

individual stocks are the third in the order of preference. The participants took interviews,

mostly stated that their objective in derivative trading would be hedging, but there were also a

few interested in derivatives dealing for speculation or dealing. The Committee believes that

regulation should be designed to achieve specific, well-defined goals. It is inclined towards

positive regulation designed to encourage healthy activity and behaviour. Let us have a brief

view of the important recommendations made by the Dr. L. C. Gupta Committee on the

introduction of derivatives markets in India. These are as under:

1. The Committee is strongly of the view that there is urgent need of introducing of financial

derivatives to facilitate market development and hedging in a most cost-efficient way

against market risk by the participants such as mutual funds and other investment

institutions.

2. There is need for equity derivatives, interest rate derivatives and currency derivatives.

3. Futures trading through derivatives should be introduced in phased manner starting with

stock index futures, which will be followed by options on index and later options on

stocks. It will enhance the efficiency and liquidity of cash markets in equities through

arbitrage process.

4. There should be two-level regulation (regulatory framework for derivatives trading), i.e.,

exchange level and SEBI level. Further, there must be considerable emphasis on self

regulatory competence of derivative exchange under the overall supervision and guidance

of SEBI.

5. The derivative trading should be initiated on a separate segment of existing stock exchanges

having an independent governing council. The number of the trading members will be

limited to 40 percent of the total number. The Chairman of the governing council will not

b trade on any of the stock exchanges.

6. The settlement of derivatives will be through an independent clearing Corporation/

Clearing house, which will become counterparty for all trades or alternatively guarantees

the settlement of all trades. The clearing corporation will have adequate risk containment

measures collect margins through EFT.

7. The derivatives exchange will have on-line-trading and adequate surveillance systems. It

will disseminate trade and price information on real time basis through two information

networks. It should inspect 100 percent of members every year.

8. There will be complete segregation of client money at the level of trading/clearing even

at the level of clearing corporation.

9. The trading and clearing member will have stringent eligibility conditions. At least two

persons should have passed the certification programme approved by the SEBI.

10. The clearing members should deposit minimum ` 50 lakh with clearing corporation and

should have a net worth of ` 3 crore.

11. Removal of the regulatory prohibition on the use of derivatives by mutual funds while

making the trustees responsible to restrict the use of derivatives by mutual funds only to

hedging and portfolio balancing and not for specification.

202 LOVELY PROFESSIONAL UNIVERSITY