Page 229 - DCOM510_FINANCIAL_DERIVATIVES

P. 229

Market Participants

1

1

Securities Appellate Tribunal (SAT)

1

4

4

Regulators*

4

Depositories FY 2010 FY 2011 As on Sep 30, 2011

2

2

2

Stock Exchanges

With Equities Trading 19 19 19

With Debt Market Segment 2 2 2

With Derivative Trading 2 2 2

Financial Derivatives

With Currency Derivatives 4 4 4

Brokers (Cash Segment)** 9,772 10,203 10,248

Corporate Brokers (Cash Segment) 4,197 4,774 4,833

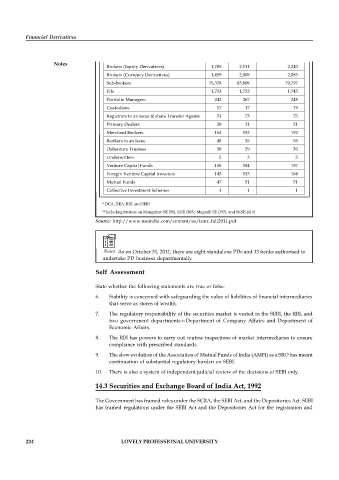

Notes

Brokers (Equity Derivatives) 1,705 2,111 2,240

Brokers (Currency Derivatives) 1,459 2,008 2,083

Sub-brokers 75,378 83,808 79,797

Flls 1,713 1,722 1,745

Portfolio Managers 242 267 248

Custodians 17 17 19

Registrars to an issue & share Transfer Agents 74 73 73

Primary Dealers 20 21 21

Merchant Bankers 164 192 192

Bankers to an Issue 48 55 56

Debenture Trustees 30 29 30

Underwriters 5 3 3

Venture Capital Funds 158 184 197

Foregin Venture Capital Investors 143 153 164

Mutual Funds 47 51 51

Collective Investment Schemes 1 1 1

* DCA, DEA, RBI, and SEBI

**Including brokers on Mangalore SE (58), HSE (303), Magadh SE (197), and SKSE (410)

Source: http://www.nseindia.com/content/us/ismr_full2011.pdf

Notes As on October 31, 2011, there are eight standalone PDs and 13 banks authorised to

undertake PD business departmentally

Self Assessment

State whether the following statements are true or false:

6. Stability is concerned with safeguarding the value of liabilities of financial intermediaries

that serve as stores of wealth.

7. The regulatory responsibility of the securities market is vested in the SEBI, the RBI, and

two government departments—Department of Company Affairs and Department of

Economic Affairs.

8. The RBI has powers to carry out routine inspections of market intermediaries to ensure

compliance with prescribed standards.

9. The slow evolution of the Association of Mutual Funds of India (AMFI) as a SRO has meant

continuation of substantial regulatory burden on SEBI.

10. There is also a system of independent judicial review of the decisions of SEBI only.

14.3 Securities and Exchange Board of India Act, 1992

The Government has framed rules under the SCRA, the SEBI Act, and the Depositories Act. SEBI

has framed regulations under the SEBI Act and the Depositories Act for the registration and

224 LOVELY PROFESSIONAL UNIVERSITY