Page 4 - DCOM510_FINANCIAL_DERIVATIVES

P. 4

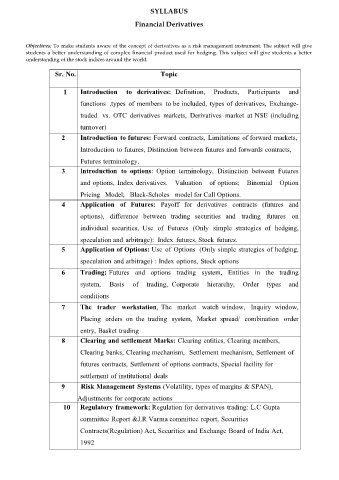

SYLLABUS

Financial Derivatives

Objectives: To make students aware of the concept of derivatives as a risk management instrument. The subject will give

students a better understanding of complex financial product used for hedging. This subject will give students a better

understanding of the stock indices around the world.

Sr. No. Topic

1 Introduction to derivatives: Definition, Products, Participants and

functions ,types of members to be included, types of derivatives, Exchange-

traded vs. OTC derivatives markets, Derivatives market at NSE (including

turnover)

2 Introduction to futures: Forward contracts, Limitations of forward markets,

Introduction to futures, Distinction between futures and forwards contracts,

Futures terminology.

3 Introduction to options: Option terminology, Distinction between Futures

and options, Index derivatives. Valuation of options; Binomial Option

Pricing Model; Black-Scholes model for Call Options.

4 Application of Futures: Payoff for derivatives contracts (futures and

options), difference between trading securities and trading futures on

individual securities, Use of Futures (Only simple strategies of hedging,

speculation and arbitrage): Index futures, Stock futures.

5 Application of Options: Use of Options (Only simple strategies of hedging,

speculation and arbitrage) : Index options, Stock options

6 Trading: Futures and options trading system, Entities in the trading

system, Basis of trading, Corporate hierarchy, Order types and

conditions

7 The trader workstation, The market watch window, Inquiry window,

Placing orders on the trading system, Market spread/ combination order

entry, Basket trading

8 Clearing and settlement Marks: Clearing entities, Clearing members,

Clearing banks, Clearing mechanism, Settlement mechanism, Settlement of

futures contracts, Settlement of options contracts, Special facility for

settlement of institutional deals

9 Risk Management Systems (Volatility, types of margins & SPAN),

Adjustments for corporate actions

10

Regulatory framework: Regulation for derivatives trading: L.C Gupta

committee Report &J.R Varma committee report, Securities

Contracts(Regulation) Act, Securities and Exchange Board of India Act,

1992