Page 59 - DCOM510_FINANCIAL_DERIVATIVES

P. 59

Financial Derivatives

Notes 4.4.3 Currency Futures

Currency future is the price of a particular currency for settlement at a specified future date.

Currency futures are traded on future exchanges and the exchanges where the contracts are

fungible (or transferable freely) are very popular. The two most popular future exchanges are

the Singapore International Monetary Exchange (SIMEX) and the International Money Market,

Chicago (IMM). Other exchanges are in London, Sydney, Frankfurt, New York, Philadelphia, etc.

The first exchange-traded foreign currency futures contracts were launched on the International

Monetary Market (IMM) – now part of the Chicago Mercantile Exchange (CME) – in 1972. Seven

currencies were traded and others have since been added. The CME remains the most active

market in these contracts to this day, though a number of other exchanges have launched their

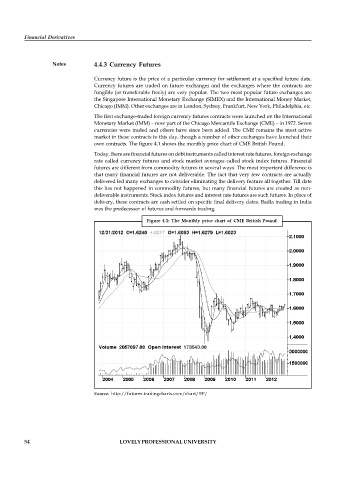

own contracts. The figure 4.1 shows the monthly price chart of CME British Pound.

Today, there are financial futures on debt instruments called interest rate futures, foreign exchange

rate called currency futures and stock market averages called stock index futures. Financial

futures are different from commodity futures in several ways. The most important difference is

that many financial futures are not deliverable. The fact that very few contracts are actually

delivered led many exchanges to consider eliminating the delivery feature all together. Till date

this has not happened in commodity futures, but many financial futures are created as non-

deliverable instruments. Stock index futures and interest rate futures are such futures. In place of

delivery, these contracts are cash settled on specific final delivery dates. Badla trading in India

was the predecessor of futures and forwards trading.

Figure 4.1: The Monthly price chart of CME British Pound

Source: http://futures.tradingcharts.com/chart/BP/

54 LOVELY PROFESSIONAL UNIVERSITY