Page 107 - DMGT409Basic Financial Management

P. 107

Basic Financial Management

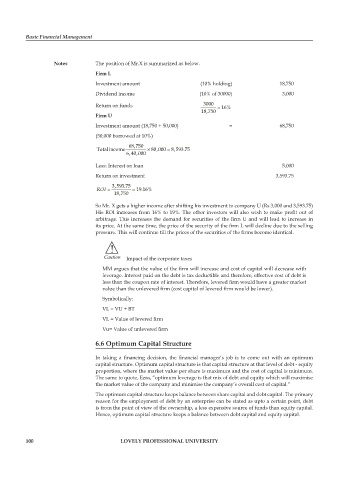

Notes The position of Mr.X is summarized as below.

Firm L

Investment amount (10% holding) 18,750

Dividend income (10% of 30000) 3,000

Return on funds 3000 = 16%

18,750

Firm U

Investment amount (18,750 + 50,000) = 68,750

(50,000 borrowed at 10%)

68,750

Totalincome × 80,000 = 8,593.75

6,40,000

Less: Interest on loan 5,000

Return on investment 3,593.75

3,593.75

ROI = = 19.16%

18,750

So Mr. X gets a higher income after shifting his investment to company U (Rs 3,000 and 3,593.75)

His ROI increases from 16% to 19%. The other investors will also wish to make profi t out of

arbitrage. This increases the demand for securities of the firm U and will lead to increase in

its price. At the same time, the price of the security of the fi rm L will decline due to the selling

pressure. This will continue till the prices of the securities of the firms become identical.

!

Caution Impact of the corporate taxes

MM argues that the value of the firm will increase and cost of capital will decrease with

leverage. Interest paid on the debt is tax deductible and therefore, effective cost of debt is

less than the coupon rate of interest. Therefore, levered firm would have a greater market

value than the unlevered firm (cost capital of levered firm would be lower).

Symbolically:

VL = VU + BT

VL = Value of levered fi rm

Vu= Value of unlevered fi rm

6.6 Optimum Capital Structure

In taking a fi nancing decision, the financial manager’s job is to come out with an optimum

capital structure. Optimum capital structure is that capital structure at that level of debt - equity

proportion, where the market value per share is maximum and the cost of capital is minimum.

The same to quote, Ezra, “optimum leverage is that mix of debt and equity which will maximise

the market value of the company and minimise the company’s overall cost of capital.”

The optimum capital structure keeps balance between share capital and debt capital. The primary

reason for the employment of debt by an enterprise can be stated as upto a certain point, debt

is from the point of view of the ownership, a less expensive source of funds than equity capital.

Hence, optimum capital structure keeps a balance between debt capital and equity capital.

100 LOVELY PROFESSIONAL UNIVERSITY