Page 128 - DMGT409Basic Financial Management

P. 128

Unit 7: Capital Budgeting

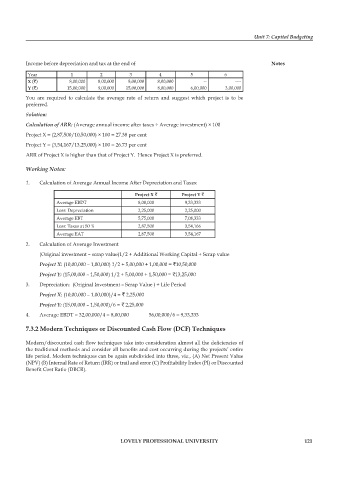

Income before depreciation and tax at the end of Notes

Year 1 2 3 4 5 6

X (`) 8,00,000 8,00,000 8,00,000 8,00,000 -- ----

Y (`) 15,00,000 9,00,000 15,00,000 8,00,000 6,00,000 3,00,000

You are required to calculate the average rate of return and suggest which project is to be

preferred.

Solution:

Calculation of ARR: (Average annual income after taxes ÷ Average investment) × 100

Project X = (2,87,500/10,50,000) × 100 = 27.38 per cent

Project Y = (3,54,167/13,25,000) × 100 = 26.73 per cent

ARR of Project X is higher than that of Project Y. Hence Project X is preferred.

Working Notes:

1. Calculation of Average Annual Income After Depreciation and Taxes:

Project X ` Project Y `

Average EBDT 8,00,000 9,33,333

Less: Depreciation 2,25,000 2,25,000

Average EBT 5,75,000 7,08,333

Less: Taxes at 50 % 2,87,500 3,54,166

Average EAT 2,87,500 3,54,167

2. Calculation of Average Investment

(Original investment – scrap value)1/2 + Additional Working Capital + Scrap value

Project X: (10,00,000 – 1,00,000) 1/2 + 5,00,000 + 1,00,000 = `10,50,000

Project Y: (15,00,000 – 1,50,000) 1/2 + 5,00,000 + 1,50,000 = `13,25,000

3. Depreciation: (Original Investment – Scrap Value ) ÷ Life Period

Project X: (10,00,000 – 1,00,000)/4 = ` 2,25,000

Project Y: (15,00,000 – 1,50,000)/6 = ` 2,25,000

4. Average EBDT = 32,00,000/4 = 8,00,000 56,00,000/6 = 9,33,333

7.3.2 Modern Techniques or Discounted Cash Flow (DCF) Techniques

Modern/discounted cash flow techniques take into consideration almost all the defi ciencies of

the traditional methods and consider all benefits and cost occurring during the projects’ entire

life period. Modern techniques can be again subdivided into three, viz., (A) Net Present Value

(NPV) (B) Internal Rate of Return (IRR) or trail and error (C) Profitability Index (PI) or Discounted

Benefit Cost Ratio (DBCR).

LOVELY PROFESSIONAL UNIVERSITY 121