Page 154 - DMGT409Basic Financial Management

P. 154

Unit 8: Working Capital Management

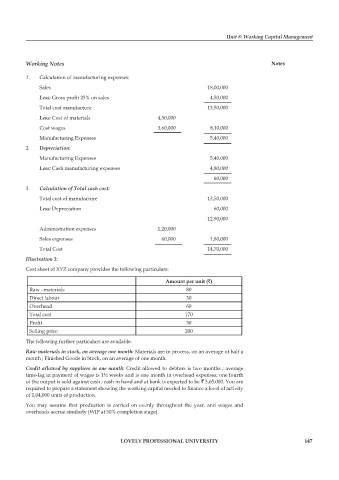

Working Notes Notes

1. Calculation of manufacturing expenses:

Sales 18,00,000

Less: Gross profit 25% on sales 4,50,000

Total cost manufacture 13,50,000

Less: Cost of materials 4,50,000

Cost wages 3,60,000 8,10,000

Manufacturing Expenses 5,40,000

2. Depreciation:

Manufacturing Expenses 5,40,000

Less: Cash manufacturing expenses 4,80,000

60,000

3. Calculation of Total cash cost:

Total cost of manufacture 13,50,000

Less: Depreciation 60,000

12,90,000

Administration expenses 1,20,000

Sales expenses 60,000 1,80,000

Total Cost 14,70,000

Illustration 3:

Cost sheet of XYZ company provides the following particulars:

Amount per unit (`)

Raw –materials 80

Direct labour 30

Overhead 60

Total cost 170

Profi t 30

Selling price 200

The following further particulars are available:

Raw materials in stock, on average one month: Materials are in process, on an average of half a

month ; Finished Goods in Stock, on an average of one month.

Credit allowed by suppliers in one month: Credit allowed to debtors is two months ; average

time-lag in payment of wages is 1½ weeks and is one month in overhead expenses; one fourth

of the output is sold against cash ; cash in hand and at bank is expected to be ` 3,65,000. You are

required to prepare a statement showing the working capital needed to finance a level of activity

of 1,04,000 units of production.

You may assume that production is carried on evenly throughout the year, and wages and

overheads accrue similarly (WIP at 50% completion stage).

LOVELY PROFESSIONAL UNIVERSITY 147