Page 220 - DMGT409Basic Financial Management

P. 220

Unit 14: Break Even Analysis

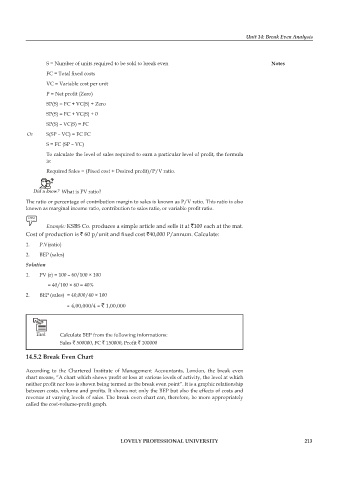

S = Number of units required to be sold to break even Notes

FC = Total fi xed costs

VC = Variable cost per unit

P = Net profi t (Zero)

SP(S) = FC + VC(S) + Zero

SP(S) = FC + VC(S) + 0

SP(S) – VC(S) = FC

Or S(SP – VC) = FC FC

S = FC (SP – VC)

To calculate the level of sales required to earn a particular level of profit, the formula

is:

Required Sales = (Fixed cost + Desired profi t)/P/V ratio.

Did u know? What is PV ratio?

The ratio or percentage of contribution margin to sales is known as P/V ratio. This ratio is also

known as marginal income ratio, contribution to sales ratio, or variable profi t ratio.

Example: KSBS Co. produces a simple article and sells it at `100 each at the mat.

Cost of production is ` 60 p/unit and fi xed cost `40,000 P/annum. Calculate:

1. P.V(ratio)

2. BEP (sales)

Solution

1. PV (r) = 100 – 60/100 × 100

= 40/100 × 60 = 40%

2. BEP (sales) = 40,000/40 × 100

= 4,00,000/4 = ` 1,00,000

Task Calculate BEP from the following informations:

Sales ` 500000, FC ` 150000, Profi t ` 100000

14.5.2 Break Even Chart

According to the Chartered Institute of Management Accountants, London, the break even

chart means, “A chart which shows profit or loss at various levels of activity, the level at which

neither profit nor loss is shown being termed as the break even point”. It is a graphic relationship

between costs, volume and profits. It shows not only the BEP but also the effects of costs and

revenue at varying levels of sales. The break even chart can, therefore, be more appropriately

called the cost-volume-profi t graph.

LOVELY PROFESSIONAL UNIVERSITY 213