Page 131 - DMGT409Basic Financial Management

P. 131

Basic Financial Management

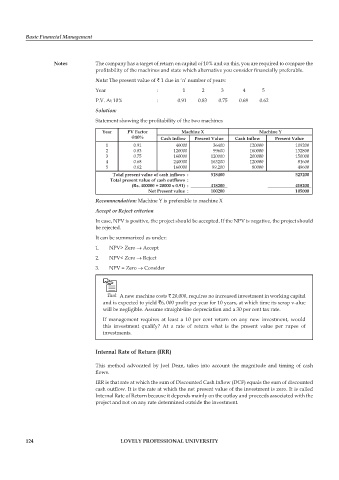

Notes The company has a target of return on capital of 10% and on this, you are required to compare the

profitability of the machines and state which alternative you consider fi nancially preferable.

Note: The present value of ` 1 due in ‘n’ number of years:

Year : 1 2 3 4 5

P.V. At 10% : 0.91 0.83 0.75 0.68 0.62

Solution:

Statement showing the profitability of the two machines

Year PV Factor Machine X Machine Y

@10% Cash Inflow Present Value Cash Infl ow Present Value

1 0.91 40000 36400 120000 109200

2 0.83 120000 99600 160000 132800

3 0.75 160000 120000 200000 150000

4 0.68 240000 163200 120000 81600

5 0.62 160000 99,200 80000 49600

Total present value of cash inflows : 518400 523200

Total present value of cash outflows :

(Rs. 400000 + 20000 x 0.91) : 418200 418200

Net Present value : 100200 105000

Recommendation: Machine Y is preferable to machine X

Accept or Reject criterion

In case, NPV is positive, the project should be accepted. If the NPV is negative, the project should

be rejected.

It can be summarized as under:

1. NPV> Zero → Accept

2. NPV< Zero → Reject

3. NPV = Zero → Consider

Task A new machine costs ` 20,000, requires no increased investment in working capital

and is expected to yield `6, 000 profit per year for 10 years, at which time its scrap v-alue

will be negligible. Assume straight-line depreciation and a 30 per cent tax rate.

If management requires at least a 10 per cent return on any new investment, would

this investment qualify? At a rate of return what is the present value per rupee of

investments.

Internal Rate of Return (IRR)

This method advocated by Joel Dean, takes into account the magnitude and timing of cash

fl ows.

IRR is that rate at which the sum of Discounted Cash Inflow (DCF) equals the sum of discounted

cash outflow. It is the rate at which the net present value of the investment is zero. It is called

Internal Rate of Return because it depends mainly on the outlay and proceeds associated with the

project and not on any rate determined outside the investment.

124 LOVELY PROFESSIONAL UNIVERSITY