Page 15 - DMGT409Basic Financial Management

P. 15

Basic Financial Management

Notes Pennsylvania. As a result of this scheduling, the firm pays all its expenses during September

and in May receives, all its revenues from its distributors within 6 weeks after the 4th of

July. The customers send their checks directly to Kenmy National Bank, where the money

is deposited in Bhatt’s account.

Mr. Bhatt is the only full-time employee of his company and he and his family hold all

the common stock. Thus, the company’s only costs are directly related to the production

of fi reworks. The costs are affected by the law of variable proportions, depending on the

production level. The first 100,000 cases cost ` 16 each; the second 100,000 cases, ` 17 each

; the third 100,000 cases, ` 18 each and the fourth 100,000 cases, ` 19 each ; the fi fth 100,000

cases, ` 20 each ; the sixth 100,000 cases, ` 21 each. As an example, the total of 200,000 cases

would be ` 1,600,000 plus ` 1,700,000 or ` 3,300,000.

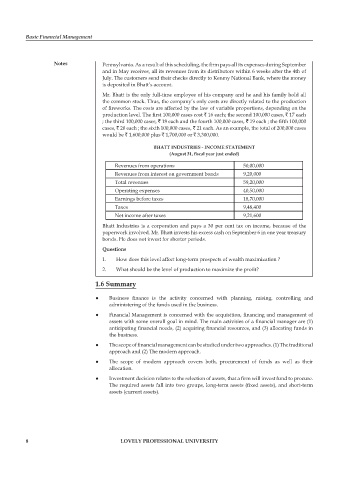

BHATT INDUSTRIES - INCOME STATEMENT

(August 31, fiscal year just ended)

Revenues from operations 50,00,000

Revenues from interest on government bonds 9,20,000

Total revenues 59,20,000

Operating expenses 40,50,000

Earnings before taxes 18,70,000

Taxes 9,48,400

Net income after taxes 9,21,600

Bhatt Industries is a corporation and pays a 30 per cent tax on income, because of the

paperwork involved. Mr. Bhatt invests his excess cash on September 6 in one year treasury

bonds. He does not invest for shorter periods.

Questions

1. How does this level affect long-term prospects of wealth maximization ?

2. What should be the level of production to maximize the profi t?

1.6 Summary

Business finance is the activity concerned with planning, raising, controlling and

administering of the funds used in the business.

Financial Management is concerned with the acquisition, financing and management of

assets with some overall goal in mind. The main activities of a financial manager are (1)

anticipating financial needs, (2) acquiring financial resources, and (3) allocating funds in

the business.

The scope of financial management can be studied under two approaches. (1) The traditional

approach and (2) The modern approach.

The scope of modern approach covers both, procurement of funds as well as their

allocation.

Investment decision relates to the selection of assets, that a firm will invest fund to procure.

The required assets fall into two groups, long-term assets (fixed assets), and short-term

assets (current assets).

8 LOVELY PROFESSIONAL UNIVERSITY