Page 190 - DMGT409Basic Financial Management

P. 190

Unit 11: Cash Management

Notes

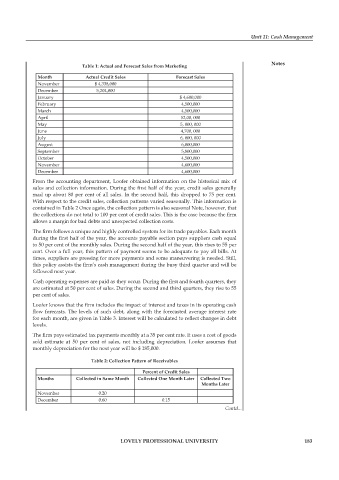

Table 1: Actual and Forecast Sales from Marketing

Month Actual Credit Sales Forecast Sales

November $ 4,338,000

December 5,204,000

January $ 4,600,000

February 4,500,000

March 4,500,000

April 52,00, 000

May 5, 000, 000

June 4,700, 000

July 6, 000, 000

August 6,000,000

September 5,800,000

October 4,500,000

November 4,600,000

December 4,600,000

From the accounting department, Loofer obtained information on the historical mix of

sales and collection information. During the first half of the year, credit sales generally

mad up about 80 per cent of all sales. In the second half, this dropped to 75 per cent.

With respect to the credit sales, collection patterns varied seasonally. This information is

contained in Table 2 Once again, the collection pattern is also seasonal Note, however, that

the collections do not total to 100 per cent of credit sales. This is the case because the fi rm

allows a margin for bad debts and unexpected collection costs.

The firm follows a unique and highly controlled system for its trade payables. Each month

during the first half of the year, the accounts payable section pays suppliers cash equal

to 50 per cent of the monthly sales. During the second half of the year, this rises to 55 per

cent. Over a full year, this pattern of payment seems to be adequate to pay all bills. At

times, suppliers are pressing for more payments and some maneuvering is needed. Still,

this policy assists the firm’s cash management during the busy third quarter and will be

followed next year.

Cash operating expenses are paid as they occur. During the first and fourth quarters, they

are estimated at 50 per cent of sales. During the second and third quarters, they rise to 55

per cent of sales.

Loofer knows that the fi rm includes the impact of interest and taxes in its operating cash

flow forecasts. The levels of such debt, along with the forecasted average interest rate

for each month, are given in Table 3. Interest will be calculated to refl ect changes in debt

levels.

The firm pays estimated tax payments monthly at a 35 per cent rate. It uses a cost of goods

sold estimate at 50 per cent of sales, not including depreciation. Loofer assumes that

monthly depreciation for the next year will be $ 185,000.

Table 2: Collection Pattern of Receivables

Percent of Credit Sales

Months Collected in Same Month Collected One Month Later Collected Two

Months Later

November 0.20

December 0.60 0.15

Contd...

LOVELY PROFESSIONAL UNIVERSITY 183