Page 119 - DMGT104_FINANCIAL_ACCOUNTING

P. 119

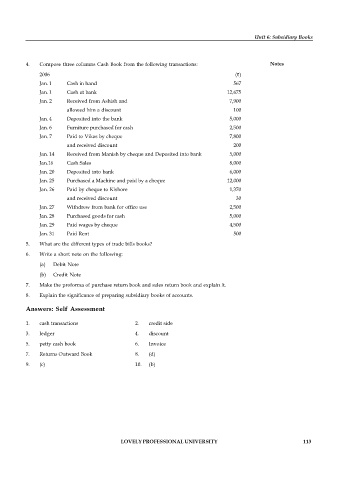

Unit 6: Subsidiary Books

4. Compose three columns Cash Book from the following transactions: Notes

2006 ( )

Jan. 1 Cash in hand 567

Jan. 1 Cash at bank 12,675

Jan. 2 Received from Ashish and 7,900

allowed him a discount 100

Jan. 4 Deposited into the bank 5,000

Jan. 6 Furniture purchased for cash 2,500

Jan. 7 Paid to Vikas by cheque 7,800

and received discount 200

Jan. 14 Received from Manish by cheque and Deposited into bank 5,000

Jan.16 Cash Sales 8,000

Jan. 20 Deposited into bank 6,000

Jan. 25 Purchased a Machine and paid by a cheque 12,000

Jan. 26 Paid by cheque to Kishore 1,370

and received discount 30

Jan. 27 Withdrew from bank for office use 2,500

Jan. 28 Purchased goods for cash 5,000

Jan. 29 Paid wages by cheque 4,500

Jan. 31 Paid Rent 500

5. What are the different types of trade bills books?

6. Write a short note on the following:

(a) Debit Note

(b) Credit Note

7. Make the proforma of purchase return book and sales return book and explain it.

8. Explain the significance of preparing subsidiary books of accounts.

Answers: Self Assessment

1. cash transactions 2. credit side

3. ledger 4. discount

5. petty cash book 6. Invoice

7. Returns Outward Book 8. (d)

9. (c) 10. (b)

LOVELY PROFESSIONAL UNIVERSITY 113