Page 15 - DMGT104_FINANCIAL_ACCOUNTING

P. 15

Unit 1: Introduction to Accounting

Notes

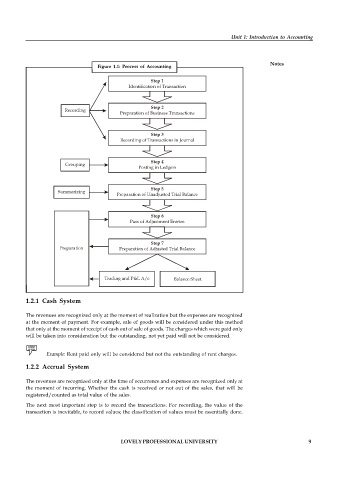

Figure 1.1: Process of Accounting

Step 1

Identification of Transaction

Step 2

Recording

Preparation of Business Transactions

Step 3

Recording of Transactions in Journal

Step 4

Grouping

Posting in Ledgers

Step 5

Summarizing

Preparation of Unadjusted Trial Balance

Step 6

Pass of Adjustment Entries

Step 7

Preparation Preparation of Adjusted Trial Balance

Trading and P&L A/c Balance Sheet

1.2.1 Cash System

The revenues are recognized only at the moment of realization but the expenses are recognized

at the moment of payment. For example, sale of goods will be considered under this method

that only at the moment of receipt of cash out of sale of goods. The charges which were paid only

will be taken into consideration but the outstanding, not yet paid will not be considered.

Example: Rent paid only will be considered but not the outstanding of rent charges.

1.2.2 Accrual System

The revenues are recognized only at the time of occurrence and expenses are recognized only at

the moment of incurring. Whether the cash is received or not out of the sales, that will be

registered/counted as total value of the sales.

The next most important step is to record the transactions. For recording, the value of the

transaction is inevitable, to record values; the classification of values must be essentially done.

LOVELY PROFESSIONAL UNIVERSITY 9