Page 237 - DMGT104_FINANCIAL_ACCOUNTING

P. 237

Unit 10: Accounting and Depreciation for Fixed Assets

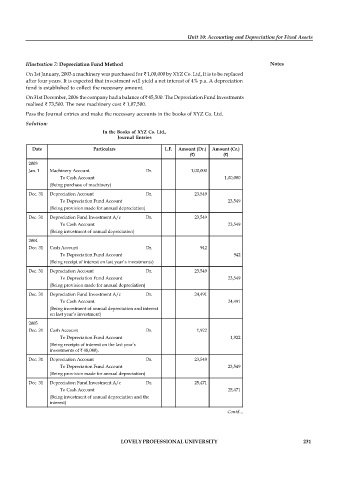

Illustration 7: Depreciation Fund Method Notes

On 1st January, 2003 a machinery was purchased for 1,00,000 by XYZ Co. Ltd, It is to be replaced

after four years. It is expected that investment will yield a net interest of 4% p.a. A depreciation

fund is established to collect the necessary amount.

On 31st December, 2006 the company had a balance of 45,500. The Depreciation Fund Investments

realised 73,500. The new machinery cost 1,07,500.

Pass the Journal entries and make the necessary accounts in the books of XYZ Co. Ltd.

Solution:

In the Books of XYZ Co. Ltd.,

Journal Entries

Date Particulars L.F. Amount (Dr.) Amount (Cr.)

( ) ( )

2003

Jan. 1 Machinery Account Dr. 1,00,000

To Cash Account 1,00,000

(Being purchase of machinery)

Dec. 31 Depreciation Account Dr. 23,549

To Depreciation Fund Account 23,549

(Being provision made for annual depreciation)

Dec. 31 Depreciation Fund Investment A/c Dr. 23,549

To Cash Account 23,549

(Being investment of annual depreciation)

2004

Dec. 31 Cash Account Dr. 942

To Depreciation Fund Account 942

(Being receipt of interest on last year’s investments)

Dec. 31 Depreciation Account Dr. 23,549

To Depreciation Fund Account 23,549

(Being provision made for annual depreciation)

Dec. 31 Depreciation Fund Investment A/c Dr. 24,491

To Cash Account 24,491

(Being investment of annual depreciation and interest

on last year’s investment)

2005

Dec. 31 Cash Account Dr. 1,922

To Depreciation Fund Account 1,922

(Being receipts of interest on the last year’s

investments of 48,040).

Dec. 31 Depreciation Account Dr. 23,549

To Depreciation Fund Account 23,549

(Being provision made for annual depreciation)

Dec. 31 Depreciation Fund Investment A/c Dr. 25,471

To Cash Account 25,471

(Being investment of annual depreciation and the

interest)

2006 Contd.. .

Dec. 31 Cash Account Dr. 2,940

To Depreciation Fund Account 2,940

(Being receipts of interest on the previous year’s

investments)

LOVELY PROFESSIONAL UNIVERSITY 231

Dec. 31 Depreciation Account Dr. 23,549

To Depreciation Fund Account 23,549

(Being provision made for annual depreciation)

2006

Dec. 31 Cash Account Dr. 73,500

Depreciation Fund Account Dr. 11

To Depreciation Fund Investment A/c. 73,511

(Being sale of D.F. Investment and loss thereon

transferred to D.F. Account)

Dec. 31 Depreciation Fund Account Dr. 1,00,000

To Machinery Account 1,00,000

(Being the transfer of machinery to depreciation fund

account)