Page 4 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 4

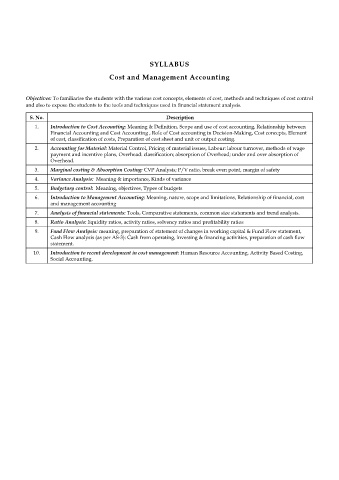

SYLLABUS

Cost and Management Accounting

Objectives: To familiarise the students with the various cost concepts, elements of cost, methods and techniques of cost control

and also to expose the students to the tools and techniques used in financial statement analysis.

S. No. Description

1. Introduction to Cost Accounting: Meaning & Definition, Scope and use of cost accounting, Relationship between

Financial Accounting and Cost Accounting , Role of Cost accounting in Decision-Making, Cost concepts, Element

of cost, classification of costs, Preparation of cost sheet and unit or output costing.

2. Accounting for Material: Material Control, Pricing of material issues, Labour: labour turnover, methods of wage

payment and incentive plans, Overhead: classification; absorption of Overhead; under and over absorption of

Overhead.

3. Marginal costing & Absorption Costing: CVP Analysis; P/V ratio, break even point, margin of safety

4. Variance Analysis: Meaning & importance, Kinds of variance

5. Budgetary control: Meaning, objectives, Types of budgets

6. Introduction to Management Accounting: Meaning, nature, scope and limitations, Relationship of fi nancial, cost

and management accounting

7. Analysis of fi nancial statements: Tools, Comparative statements, common size statements and trend analysis.

8. Ratio Analysis: liquidity ratios, activity ratios, solvency ratios and profi tability ratios

9. Fund Flow Analysis: meaning, preparation of statement of changes in working capital & Fund Flow statement,

Cash Flow analysis (as per AS-3): Cash from operating, investing & financing activities, preparation of cash fl ow

statement.

10. Introduction to recent development in cost management: Human Resource Accounting, Activity Based Costing,

Social Accounting.