Page 180 - DMGT303_BANKING_AND_INSURANCE

P. 180

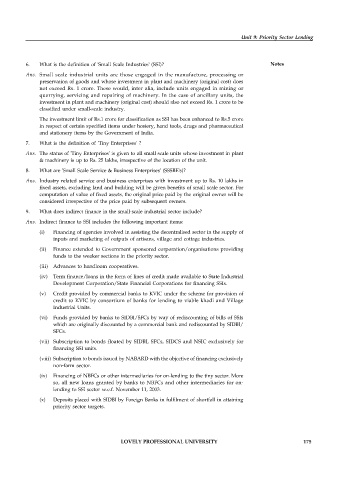

Unit 9: Priority Sector Lending

6. What is the definition of 'Small Scale Industries' (SSI)? Notes

Ans. Small scale industrial units are those engaged in the manufacture, processing or

preservation of goods and whose investment in plant and machinery (original cost) does

not exceed Rs. 1 crore. These would, inter alia, include units engaged in mining or

quarrying, servicing and repairing of machinery. In the case of ancillary units, the

investment in plant and machinery (original cost) should also not exceed Rs. 1 crore to be

classified under small-scale industry.

The investment limit of Rs.1 crore for classification as SSI has been enhanced to Rs.5 crore

in respect of certain specified items under hosiery, hand tools, drugs and pharmaceutical

and stationery items by the Government of India.

7. What is the definition of 'Tiny Enterprises' ?

Ans. The status of 'Tiny Enterprises' is given to all small scale units whose investment in plant

& machinery is up to Rs. 25 lakhs, irrespective of the location of the unit.

8. What are 'Small Scale Service & Business Enterprises' (SSSBE's)?

Ans. Industry related service and business enterprises with investment up to Rs. 10 lakhs in

fixed assets, excluding land and building will be given benefits of small scale sector. For

computation of value of fixed assets, the original price paid by the original owner will be

considered irrespective of the price paid by subsequent owners.

9. What does indirect finance in the small-scale industrial sector include?

Ans. Indirect finance to SSI includes the following important items:

(i) Financing of agencies involved in assisting the decentralised sector in the supply of

inputs and marketing of outputs of artisans, village and cottage industries.

(ii) Finance extended to Government sponsored corporation/organisations providing

funds to the weaker sections in the priority sector.

(iii) Advances to handloom cooperatives.

(iv) Term finance/loans in the form of lines of credit made available to State Industrial

Development Corporation/State Financial Corporations for financing SSIs.

(v) Credit provided by commercial banks to KVIC under the scheme for provision of

credit to KVIC by consortium of banks for lending to viable khadi and Village

Industrial Units.

(vi) Funds provided by banks to SIDBI/SFCs by way of rediscounting of bills of SSIs

which are originally discounted by a commercial bank and rediscounted by SIDBI/

SFCs.

(vii) Subscription to bonds floated by SIDBI, SFCs, SIDCS and NSIC exclusively for

financing SSI units.

(viii) Subscription to bonds issued by NABARD with the objective of financing exclusively

non-farm sector.

(ix) Financing of NBFCs or other intermediaries for on-lending to the tiny sector. More

so, all new loans granted by banks to NBFCs and other intermediaries for on-

lending to SSI sector w.e.f. November 11, 2003.

(x) Deposits placed with SIDBI by Foreign Banks in fulfilment of shortfall in attaining

priority sector targets.

LOVELY PROFESSIONAL UNIVERSITY 175