Page 278 - DMGT303_BANKING_AND_INSURANCE

P. 278

Unit 13: General Insurance

or unexpected event caused either by accident or incident that cannot be forecasted. The contract Notes

of fire insurance is valid as long as the assured has an insurable interest in the asset insured. In

the absence of the insurable interest in the contract of insurance, the contract becomes a wagering

contract and thus becomes void.

13.5 Nature of Fire Insurance Contract

All the essential elements of an insurance contract are present in a fire insurance contract. The

essential elements are mentioned below:

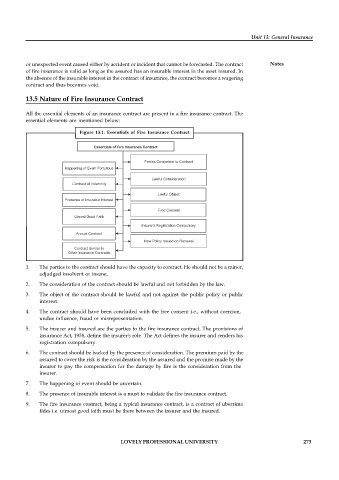

Figure 13.1: Essentials of Fire Insurance Contract

1. The parties to the contract should have the capacity to contract. He should not be a minor,

adjudged insolvent or insane.

2. The consideration of the contract should be lawful and not forbidden by the law.

3. The object of the contract should be lawful and not against the public policy or public

interest.

4. The contract should have been concluded with the free consent i.e., without coercion,

undue influence, fraud or misrepresentation.

5. The insurer and insured are the parties to the fire insurance contract. The provisions of

Insurance Act, 1938, define the insurer's role. The Act defines the insurer and renders his

registration compulsory.

6. The contract should be backed by the presence of consideration. The premium paid by the

assured to cover the risk is the consideration by the assured and the promise made by the

insurer to pay the compensation for the damage by fire is the consideration from the

insurer.

7. The happening of event should be uncertain.

8. The presence of insurable interest is a must to validate the fire insurance contract.

9. The fire insurance contract, being a typical insurance contract, is a contract of uberrima

fides i.e. utmost good faith must be there between the insurer and the insured.

LOVELY PROFESSIONAL UNIVERSITY 273