Page 300 - DMGT303_BANKING_AND_INSURANCE

P. 300

Unit 14: Marine and Motor Insurance

14.4 Kinds of Marine Insurance Policies Notes

Though commonly in one form, marine policies are known by different names according to

their manner of execution and the nature of risks covered. The following are the various kinds

of marine insurance policies as contained in the Marine Insurance Act 1963.

1. Voyage Policy: As the name suggests this policy covers a voyage. This is a policy in which

the limits of the risks are determined by place of particular voyage. For example, Madras

to Singapore; Madras to London. Such policies are always used for goods insurance,

sometimes for freight insurance, but only rarely nowadays for hull insurance.

2. Time Policy: This policy is designed to give cover for some specified period of time, say,

for example 1st Jan, 2003 to noon, 1st Jan, 2004. Time policies are usual in the case of hull

insurance, though there may be cases where an owner prefers to insure his vessel for each

separate voyage under voyage policy.

3. Voyage and Time Policy or Mixed Policy: It is a combination of Voyage and Time Policy.

It is a policy, which covers the risk during a particular voyage for a specified period. For

example, a ship may be insured for voyages between Madras to London for a period of

one year.

4. Valued Policy: This policy specifies the agreed value of the subject matter insured, which

is not necessarily the actual value. Such agreed value is referred to as the insured value. A

policy may be, say, for Rs. 10000 on Hull and Machinery etc.

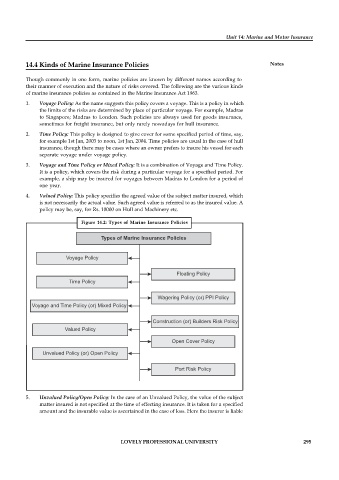

Figure 14.2: Types of Marine Insurance Policies

Types of Marine Insurance Policies

Voyage Policy

Floating Policy

Time Policy

Wagering Policy (or) PPI Policy

Voyage and Time Policy (or) Mixed Policy

Construction (or) Builders Risk Policy

Valued Policy

Open Cover Policy

Unvalued Policy (or) Open Policy

Port Risk Policy

5. Unvalued Policy/Open Policy: In the case of an Unvalued Policy, the value of the subject

matter insured is not specified at the time of effecting insurance. It is taken for a specified

amount and the insurable value is ascertained in the case of loss. Here the insurer is liable

LOVELY PROFESSIONAL UNIVERSITY 295