Page 242 - DMGT306_MERCANTILE_LAWS_II

P. 242

Unit 12: Payment of Bonus Act, 1965

Notes

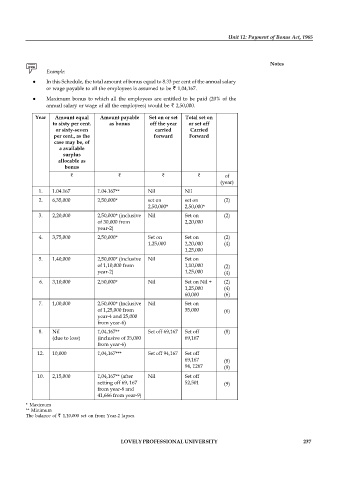

Example:

In this Schedule, the total amount of bonus equal to 8.33 per cent of the annual salary

or wage payable to all the employees is assumed to be 1,04,167.

Maximum bonus to which all the employees are entitled to be paid (20% of the

annual salary or wage of all the employees) would be 2,50,000.

Year Amount equal Amount payable Set on or set Total set on

to sixty per cent. as bonus off the year or set off

or sixty-seven carried Carried

per cent., as the forward Forward

case may be, of

a available

surplus

allocable as

bonus

of

(year)

1. 1.04.167 1.04.167** Nil Nil

2. 6,35,000 2,50,000* set on set on (2)

2,50,000* 2,50,000*

3. 2,20,000 2,50,000* (inclusive Nil Set on (2)

of 30,000 from 2,20,000

year-2)

4. 3,75,000 2,50,000* Set on Set on (2)

1,25,000 2,20,000 (4)

1,25,000

5. 1,40,000 2,50,000* (inclusive Nil Set on

of 1,10,000 from 1,10,000 (2)

year-2) 1,25,000 (4)

6. 3,10,000 2,50,000* Nil Set on Nil + (2)

1,25,000 (4)

60,000 (6)

7. 1,00,000 2,50,000* (Inclusive Nil Set on

of 1,25,000 from 35,000 (6)

year-4 and 25,000

from year-6)

8. Nil 1,04,167** Set off 69,167 Set off (8)

(due to loss) (inclusive of 35,000 69,167

from year-6)

12. 10,000 1,04,167*** Set off 94,167 Set off

69,167 (8)

94, 1267 (9)

10. 2,15,000 1,04,167** (after Nil Set off

setting off 69, 167 52,501 (9)

from year-8 and

41,666 from year-9)

* Maximum

** Minimum

The balance of 1,10,000 set on from Year-2 lapses.

LOVELY PROFESSIONAL UNIVERSITY 237