Page 38 - DMGT308_CUSTOMER_RELATIONSHIP_MANAGEMENT

P. 38

Unit 2: Customer Value

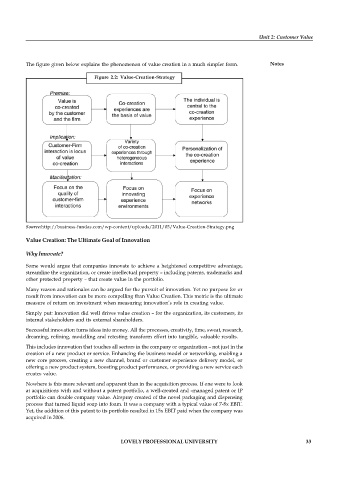

The figure given below explains the phenomenon of value creation in a much simpler form. Notes

Figure 2.2: Value-Creation-Strategy

Source:http://business-fundas.com/wp-content/uploads/2011/05/Value-Creation-Strategy.png

Value Creation: The Ultimate Goal of Innovation

Why Innovate?

Some would argue that companies innovate to achieve a heightened competitive advantage,

streamline the organization, or create intellectual property – including patents, trademarks and

other protected property – that create value in the portfolio.

Many reason and rationales can be argued for the pursuit of innovation. Yet no purpose for or

result from innovation can be more compelling than Value Creation. This metric is the ultimate

measure of return on investment when measuring innovation’s role in creating value.

Simply put: Innovation did well drives value creation – for the organization, its customers, its

internal stakeholders and its external shareholders.

Successful innovation turns ideas into money. All the processes, creativity, time, sweat, research,

dreaming, refining, modelling and retesting transform effort into tangible, valuable results.

This includes innovation that touches all sectors in the company or organization – not just in the

creation of a new product or service. Enhancing the business model or networking, enabling a

new core process, creating a new channel, brand or customer experience delivery model, or

offering a new product system, boosting product performance, or providing a new service each

creates value.

Nowhere is this more relevant and apparent than in the acquisition process. If one were to look

at acquisitions with and without a patent portfolio, a well-created and -managed patent or IP

portfolio can double company value. Airspray created of the novel packaging and dispensing

process that turned liquid soap into foam. It was a company with a typical value of 7-8x EBIT.

Yet, the addition of this patent to its portfolio resulted in 15x EBIT paid when the company was

acquired in 2006.

LOVELY PROFESSIONAL UNIVERSITY 33