Page 94 - DMGT407Corporate and Business Laws

P. 94

Unit 4: Law of Negotiable Instruments

Notes

In the run up to the Union Budget, the President of the Federation of Indian Export

Organisations (FIEO), Mr Rafeeque Ahmed, had urged the Finance Minister, Mr P.

Chidambaram, to withdraw this levy on exporters.

Exporters are required to affix foreign bill stamps on their usance bills of above 90 days

and up to 180 days.

Source: thehindubusinessline.com

Self Assessment

Fill in the blanks:

3. The promissory note must be signed by the………………., otherwise it is of no effect.

4. The ……….of a bill is the indication by the drawee of his assent to the order of the drawer.

4.3 Cheques

4.3.1 Meaning of a Cheque

A cheque is the usual method of withdrawing money from a current account with a banker.

Savings bank accounts are also permitted to be operated by cheques provided certain minimum

balance is maintained. A cheque, in essence, is an order by the customer of the bank directing his

banker to pay on demand, the specified amount, to or to the order of the person named therein

or to the bearer. Section 6 defines a cheque. The Amendment Act, 2002 has substituted new

section for s.6. It provides that a ‘cheque’ is a bill of exchange drawn on a specified banker and

not expressed to be payable otherwise than on demand and it includes the electronic image of a

truncated cheque and a cheque in the electronic form.

‘A cheque in the electronic form’ means a cheque which contains the exact mirror image of a

paper cheque, and is generated, written and signed in a secure system ensuring the minimum

safety standards with the use of digital signature (with or without biometrics signature) and

asymmetric crypto system.

‘A truncated cheque’ means a cheque which is truncated during the course of a clearing cycle,

either by the clearing house or by the bank whether paying or receiving payment, immediately

on generation of an electronic image for transmission, substituting the further physical movement

of the cheque in writing.

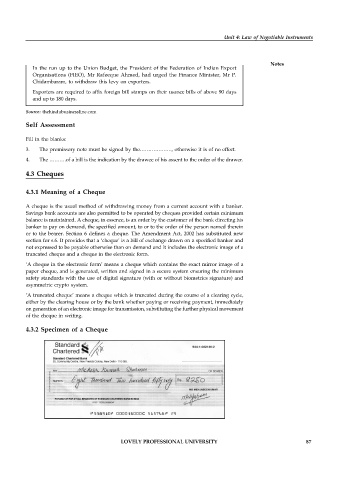

4.3.2 Specimen of a Cheque

LOVELY PROFESSIONAL UNIVERSITY 87