Page 65 - DMGT512_FINANCIAL_INSTITUTIONS_AND_SERVICES

P. 65

Financial Institutions and Services

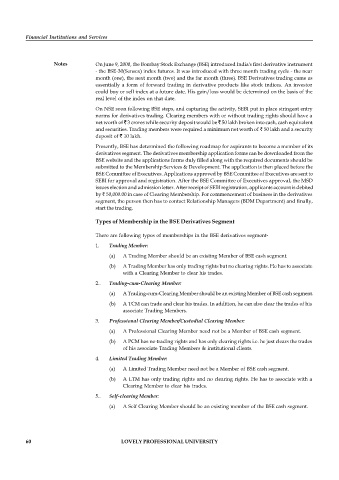

Notes On June 9, 2000, the Bombay Stock Exchange (BSE) introduced India's first derivative instrument

- the BSE-30(Sensex) index futures. It was introduced with three month trading cycle - the near

month (one), the next month (two) and the far month (three). BSE Derivatives trading came as

essentially a form of forward trading in derivative products like stock indices. An investor

could buy or sell index at a future date. His gain/loss would be determined on the basis of the

real level of the index on that date.

On NSE soon following BSE steps, and capturing the activity, SEBI put in place stringent entry

norms for derivatives trading. Clearing members with or without trading rights should have a

net worth of 3 crores while security deposit would be 50 lakh broken into cash, cash equivalent

and securities. Trading members were required a minimum net worth of 50 lakh and a security

deposit of 10 lakh.

Presently, BSE has determined the following roadmap for aspirants to become a member of its

derivatives segment. The derivatives membership application forms can be downloaded from the

BSE website and the applications forms duly filled along with the required documents should be

submitted to the Membership Services & Development. The application is then placed before the

BSE Committee of Executives. Applications approved by BSE Committee of Executives are sent to

SEBI for approval and registration. After the BSE Committee of Executives approval, the MSD

issues election and admission letter. After receipt of SEBI registration, applicants account is debited

by 50,000.00 in case of Clearing Membership. For commencement of business in the derivatives

segment, the person then has to contact Relationship Managers (BDM Department) and finally,

start the trading.

Types of Membership in the BSE Derivatives Segment

There are following types of memberships in the BSE derivatives segment-

1. Trading Member:

(a) A Trading Member should be an existing Member of BSE cash segment.

(b) A Trading Member has only trading rights but no clearing rights. He has to associate

with a Clearing Member to clear his trades.

2.. Trading-cum-Clearing Member:

(a) A Trading-cum-Clearing Member should be an existing Member of BSE cash segment.

(b) A TCM can trade and clear his trades. In addition, he can also clear the trades of his

associate Trading Members.

3. Professional Clearing Member/Custodial Clearing Member:

(a) A Professional Clearing Member need not be a Member of BSE cash segment.

(b) A PCM has no trading rights and has only clearing rights i.e. he just clears the trades

of his associate Trading Members & institutional clients.

4. Limited Trading Member:

(a) A Limited Trading Member need not be a Member of BSE cash segment.

(b) A LTM has only trading rights and no clearing rights. He has to associate with a

Clearing Member to clear his trades.

5.. Self-clearing Member:

(a) A Self Clearing Member should be an existing member of the BSE cash segment.

60 LOVELY PROFESSIONAL UNIVERSITY