Page 8 - DMGT512_FINANCIAL_INSTITUTIONS_AND_SERVICES

P. 8

Unit 1: Financial System

Notes

Caselet Outlook for Indian Financial Markets: Stocks up,

Rates Down?

ndian markets, with their increasing levels of integration with the international

markets, have not been an exception to the corrections taking place in global markets

Inow. But, as a consequence of the fact that our level of integration with the global

markets is still only "increasing" and there is yet some policy restriction with respect to

seamless flow of capital between the local and international markets, there have been

differing reactions in various segments of the financial markets in India.

Equities have fallen quite sharply as the international exposure of the domestic stock

markets is relatively much higher than that of the other key financial market segment,

namely, debt.

The debt markets, dominated by government debt and with very limited international

participation, have been influenced only by prevailing liquidity conditions (and perceptions

about the same) in the domestic banking system.

Sovereign bond yields have moved up in the past couple of weeks, particularly in the last

couple of days, as the Reserve Bank of India put in place some measures for broadly

stabilising/restricting the liquidity level in the financial system.

Therefore, while equity markets have moved in sympathy with stocks globally, the Indian

bond market has seen yields rising while globally sovereign bond yields have fallen

substantially.

Source: www.thehindubusinessline.com

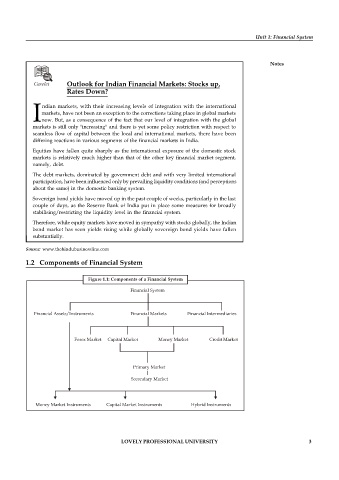

1.2 Components of Financial System

Figure 1.1: Components of a Financial System

Financial System

Financial Assets/Instruments Financial Markets Financial Intermediaries

Forex Market Capital Market Money Market Credit Market

Primary Market

Secondary Market

Money Market Instruments Capital Market Instruments Hybrid Instruments

LOVELY PROFESSIONAL UNIVERSITY 3