Page 231 - DMGT516_LABOUR_LEGISLATIONS

P. 231

Labour Legislations

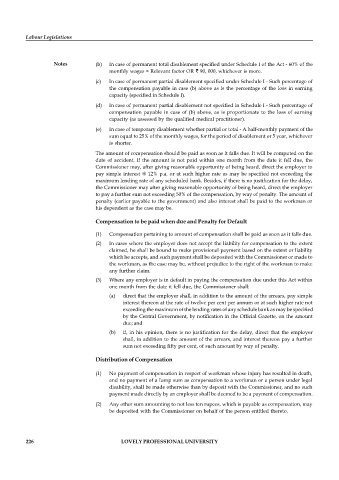

Notes (b) In case of permanent total disablement specified under Schedule I of the Act - 60% of the

monthly wages × Relevant factor OR 90, 000, whichever is more.

(c) In case of permanent partial disablement specified under Schedule I - Such percentage of

the compensation payable in case (b) above as is the percentage of the loss in earning

capacity (specified in Schedule I).

(d) In case of permanent partial disablement not specified in Schedule I - Such percentage of

compensation payable in case of (b) above, as is proportionate to the loss of earning

capacity (as assessed by the qualified medical practitioner).

(e) In case of temporary disablement whether partial or total - A half-monthly payment of the

sum equal to 25% of the monthly wages, for the period of disablement or 5 year, whichever

is shorter.

The amount of compensation should be paid as soon as it falls due. It will be computed on the

date of accident. If the amount is not paid within one month from the date it fell due, the

Commissioner may, after giving reasonable opportunity of being heard, direct the employer to

pay simple interest @ 12% p.a. or at such higher rate as may be specified not exceeding the

maximum lending rate of any scheduled bank. Besides, if there is no justification for the delay,

the Commissioner may after giving reasonable opportunity of being heard, direct the employer

to pay a further sum not exceeding 50% of the compensation, by way of penalty. The amount of

penalty (earlier payable to the government) and also interest shall be paid to the workman or

his dependent as the case may be.

Compensation to be paid when due and Penalty for Default

(1) Compensation pertaining to amount of compensation shall be paid as soon as it falls due.

(2) In cases where the employer does not accept the liability for compensation to the extent

claimed, he shall be bound to make provisional payment based on the extent or liability

which he accepts, and such payment shall be deposited with the Commissioner or made to

the workman, as the case may be, without prejudice to the right of the workman to make

any further claim.

(3) Where any employer is in default in paying the compensation due under this Act within

one month from the date it fell due, the Commissioner shall:

(a) direct that the employer shall, in addition to the amount of the arrears, pay simple

interest thereon at the rate of twelve per cent per annum or at such higher rate not

exceeding the maximum of the lending rates of any schedule bank as may be specified

by the Central Government, by notification in the Official Gazette, on the amount

due; and

(b) if, in his opinion, there is no justification for the delay, direct that the employer

shall, in addition to the amount of the arrears, and interest thereon pay a further

sum not exceeding fifty per cent, of such amount by way of penalty.

Distribution of Compensation

(1) No payment of compensation in respect of workman whose injury has resulted in death,

and no payment of a lump sum as compensation to a workman or a person under legal

disability, shall be made otherwise than by deposit with the Commissioner, and no such

payment made directly by an employer shall be deemed to be a payment of compensation.

(2) Any other sum amounting to not less ten rupees, which is payable as compensation, may

be deposited with the Commissioner on behalf of the person entitled thereto.

226 LOVELY PROFESSIONAL UNIVERSITY