Page 187 - DMGT545_INTERNATIONAL_BUSINESS

P. 187

International Business

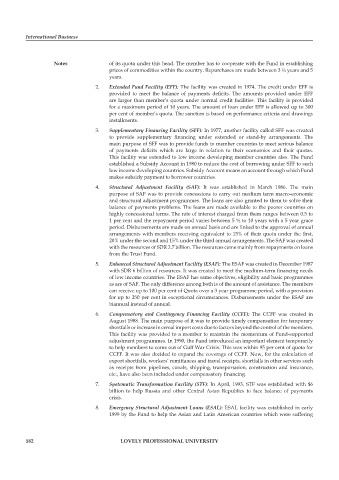

notes of its quota under this head. The member has to cooperate with the Fund in establishing

prices of commodities within the country. Repurchases are made between 3 ¼ years and 5

years.

2. Extended Fund Facility (EFF): The facility was created in 1974. The credit under EFF is

provided to meet the balance of payments deficits. The amounts provided under EFF

are larger than member’s quota under normal credit facilities. This facility is provided

for a maximum period of 10 years. The amount of loan under EFF is allowed up to 300

per cent of member’s quota. The sanction is based on performance criteria and drawings

installments.

3. Supplementary Financing Facility (SFF): In 1977, another facility called SFF was created

to provide supplementary financing under extended or stand-by arrangements. The

main purpose of SFF was to provide funds to member countries to meet serious balance

of payments deficits which are large in relation to their economies and their quotas.

This facility was extended to low income developing member countries also. The Fund

established a Subsidy Account in 1980 to reduce the cost of borrowing under SFF to such

low income developing countries. Subsidy Account means an account through which Fund

makes subsidy payment to borrower countries.

4. Structural Adjustment Facility (SAF): It was established in March 1986. The main

purpose of SAF was to provide concessions to carry out medium term macro-economic

and structural adjustment programmes. The loans are also granted to them to solve their

balance of payments problems. The loans are made available to the poorer countries on

highly concessional terms. The rate of interest charged from them ranges between 0.5 to

1 per cent and the repayment period varies between 5 ½ to 10 years with a 5 year grace

period. Disbursements are made on annual basis and are linked to the approval of annual

arrangements with members receiving equivalent to 15% of their quota under the first,

20% under the second and 15% under the third annual arrangements. The SAF was created

with the resources of SDR 2.7 billion. The resources came mainly from repayments on loans

from the Trust Fund.

5. Enhanced Structural Adjustment Facility (ESAF): The ESAF was created in December 1987

with SDR 6 billion of resources. It was created to meet the medium-term financing needs

of low income countries. The ESAF has same objectives, eligibility and basic programmes

as are of SAF. The only difference among both is of the amount of assistance. The members

can receive up to 100 per cent of Quota over a 3 year programme period, with a provision

for up to 250 per cent in exceptional circumstances. Disbursements under the ESAF are

biannual instead of annual.

6. Compensatory and Contingency Financing Facility (CCFF): The CCFF was created in

August 1988. The main purpose of it was to provide timely compensation for temporary

shortfalls or increase in cereal import costs due to factors beyond the control of the members.

This facility was provided to a member to maintain the momentum of Fund-supported

adjustment programmes. In 1990, the Fund introduced an important element temporarily

to help members to come out of Gulf War Crisis. This was within 95 per cent of quota for

CCFF. It was also decided to expand the coverage of CCFF. Now, for the calculation of

export shortfalls, workers’ remittances and travel receipts, shortfalls in other services such

as receipts from pipelines, canals, shipping, transportation, construction and insurance,

etc., have also been included under compensatory financing.

7. Systematic Transformation Facility (STF): In April, 1993, STF was established with $6

billion to help Russia and other Central Asian Republics to face balance of payments

crisis.

8. Emergency Structural Adjustment Loans (ESAL): ESAL facility was established in early

1999 by the Fund to help the Asian and Latin American countries which were suffering

182 lovely Professional university