Page 152 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 152

Unit 11: Credit Derivatives

Notes

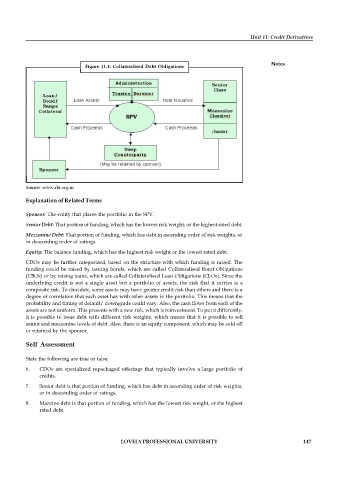

Figure 11.1: Collateralised Debt Obligations

Source: www.rbi.org.in

Explanation of Related Terms

Sponsor: The entity that places the portfolio in the SPV.

Senior Debt: That portion of funding, which has the lowest risk weight, or the highest rated debt.

Mezzanine Debt: That portion of funding, which has debt in ascending order of risk weights, or

in descending order of ratings.

Equity: The balance funding, which has the highest risk weight or the lowest rated debt.

CDOs may be further categorized, based on the structure with which funding is raised. The

funding could be raised by issuing bonds, which are called Collateralised Bond Obligations

(CBOs) or by raising loans, which are called Collateralised Loan Obligations (CLOs). Since the

underlying credit is not a single asset but a portfolio of assets, the risk that it carries is a

composite risk. To elucidate, some assets may have greater credit risk than others and there is a

degree of correlation that each asset has with other assets in the portfolio. This means that the

probability and timing of default/ downgrade could vary. Also, the cash flows from each of the

assets are not uniform. This presents with a new risk, which is reinvestment. To put it differently,

it is possible to issue debt with different risk weights, which means that it is possible to sell

senior and mezzanine levels of debt. Also, there is an equity component, which may be sold off

or retained by the sponsor.

Self Assessment

State the following are true or false:

6. CDOs are specialized repackaged offerings that typically involve a large portfolio of

credits.

7. Senior debt is that portion of funding, which has debt in ascending order of risk weights,

or in descending order of ratings.

8. Mazzine debt is that portion of funding, which has the lowest risk weight, or the highest

rated debt.

LOVELY PROFESSIONAL UNIVERSITY 147