Page 90 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 90

Unit 7: Option Strategies and Pay-offs

Notes

Profit/Loss on Put option

Stock Price Premium paid Net Profit /Loss

purchased

495 +45 -12 + 33

505 +35 -12 +23

515 +25 -12 +13

525 +15 -12 +3

535 +5 -12 -7

540 0 -12 -12

550 0 (NE) -12 -12

570 0 (NE) -12 -12

575 0 (NE) -12 -12

590 0 (NE) -12 -12

NE: not exercised

The maximum profit is ` 528 i.e., when the stock price takes hypothetical zero value. The

maximum loss is limited to option premium paid, i.e, ` 12.

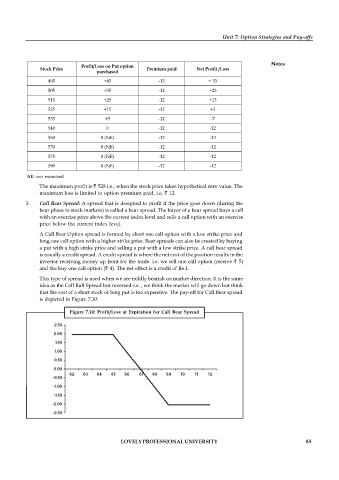

3. Call Bear Spread: A spread that is designed to profit if the price goes down (during the

bear phase in stock markets) is called a bear spread. The buyer of a bear spread buys a call

with an exercise price above the current index level and sells a call option with an exercise

price below the current index level.

A Call Bear Option spread is formed by short one call option with a low strike price and

long one call option with a higher strike price. Bear spreads can also be created by buying

a put with a high strike price and selling a put with a low strike price. A call bear spread

is usually a credit spread. A credit spread is where the net cost of the position results in the

investor receiving money up front for the trade. i.e. we sell one call option (receive ` 5)

and the buy one call option (` 4). The net effect is a credit of Re.1.

This type of spread is used when we are mildly bearish on market direction. It is the same

idea as the Call Bull Spread but reversed-i.e. , we think the market will go down but think

that the cost of a short stock or long put is too expensive. The pay-off for Call Bear spread

is depicted in Figure 7.10.

Figure 7.10: Profit/Loss at Expiration for Call Bear Spread

LOVELY PROFESSIONAL UNIVERSITY 85