Page 156 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 156

Unit 8: Insurance Planning

3. The owner of or other person interested in or responsible for, insurable property by Notes

reason of maritime perils may insure any liability to the third party.

Voyage

Voyage is the journey that the vessel undertakes. The route of the ship is very important in the

marine insurance business. The ship should carry on the voyage in the specified route, which is

mentioned in the policy. Change of voyage is permitted only in a few specified circumstances.

Maritime Perils/Perils of the Sea

Maritime Perils are also called “Perils of the Sea”. It means the perils consequent on, or incidental

to the navigation through the sea for example – fire, war perils, rovers, thieves, captures, seizures,

jettisons, barratry and any other perils.

The term “Perils of the Sea” refers only to fortuitous accidents or casualties of the sea, and does

not include the ordinary action of winds and waves.

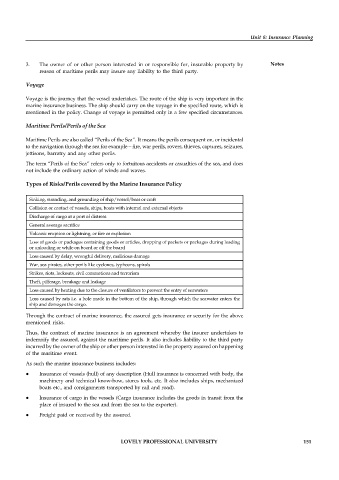

Types of Risks/Perils covered by the Marine Insurance Policy

Sinking, stranding, and grounding of ship/vessel/boat or craft

Collision or contact of vessels, ships, boats with internal and external objects

Discharge of cargo at a port of distress

General average sacrifice

Volcanic eruption or lightning, or fire or explosion

Loss of goods or packages containing goods or articles, dropping of packets or packages during loading

or unloading or while on board or off the board

Loss caused by delay, wrongful delivery, malicious damage

War, sea pirates, other perils like cyclones, typhoons, spirals

Strikes, riots, lockouts, civil commotions and terrorism

Theft, pilferage, breakage and leakage

Loss caused by heating due to the closure of ventilators to prevent the entry of seawaters

Loss caused by rats i.e. a hole made in the bottom of the ship, through which the seawater enters the

ship and damages the cargo.

Through the contract of marine insurance, the assured gets insurance or security for the above

mentioned risks.

Thus, the contract of marine insurance is an agreement whereby the insurer undertakes to

indemnify the assured, against the maritime perils. It also includes liability to the third party

incurred by the owner of the ship or other person interested in the property assured on happening

of the maritime event.

As such the marine insurance business includes:

Insurance of vessels (hull) of any description (Hull insurance is concerned with body, the

machinery and technical know-how, stores tools, etc. It also includes ships, mechanized

boats etc., and consignments transported by rail and road).

Insurance of cargo in the vessels (Cargo insurance includes the goods in transit from the

place of insured to the sea and from the sea to the exporter).

Freight paid or received by the assured.

LOVELY PROFESSIONAL UNIVERSITY 151