Page 188 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 188

Unit 10: Retirement Planning-II

10. Diversification will help you to reduce the amount of risk in your portfolio, increasing the Notes

chances that you’ll reach your retirement savings goals.

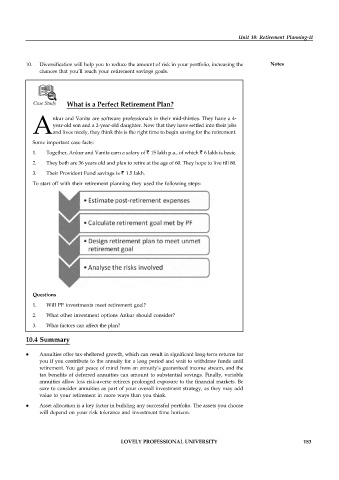

Case Study What is a Perfect Retirement Plan?

nkur and Vanita are software professionals in their mid-thirties. They have a 4-

year-old son and a 2-year-old daughter. Now that they have settled into their jobs

Aand lives nicely, they think this is the right time to begin saving for the retirement.

Some important case facts:

1. Together, Ankur and Vanita earn a salary of ` 15 lakh p.a., of which ` 6 lakh is basic.

2. They both are 36 years old and plan to retire at the age of 60. They hope to live till 80.

3. Their Provident Fund savings is ` 1.5 lakh.

To start off with their retirement planning they used the following steps:

Questions

1. Will PF investments meet retirement goal?

2. What other investment options Ankur should consider?

3. What factors can affect the plan?

10.4 Summary

Annuities offer tax-sheltered growth, which can result in significant long-term returns for

you if you contribute to the annuity for a long period and wait to withdraw funds until

retirement. You get peace of mind from an annuity’s guaranteed income stream, and the

tax benefits of deferred annuities can amount to substantial savings. Finally, variable

annuities allow less risk-averse retirees prolonged exposure to the financial markets. Be

sure to consider annuities as part of your overall investment strategy, as they may add

value to your retirement in more ways than you think.

Asset allocation is a key factor in building any successful portfolio. The assets you choose

will depend on your risk tolerance and investment time horizon.

LOVELY PROFESSIONAL UNIVERSITY 183