Page 80 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 80

Unit 4: Measuring Investment Return

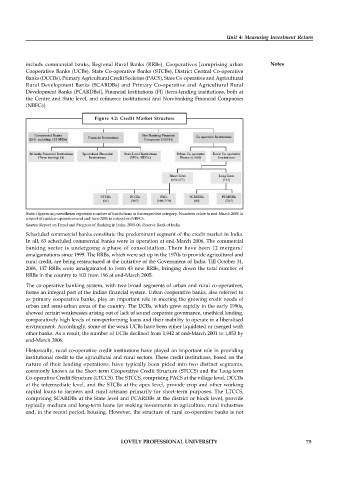

include commercial banks, Regional Rural Banks (RRBs), Cooperatives [comprising urban Notes

Cooperative Banks (UCBs), State Co-operative Banks (STCBs), District Central Co-operative

Banks (DCCBs), Primary Agricultural Credit Societies (PACS), State Co-operative and Agricultural

Rural Development Banks (SCARDBs) and Primary Co-operative and Agricultural Rural

Development Banks (PCARDBs)], Financial Institutions (FI) (term-lending institutions, both at

the Centre and State level, and refinance institutions) and Non-banking Financial Companies

(NBFCs).

Figure 4.2: Credit Market Structure

Note: Figures in parentheses represent number of institutions in the respective category. Numbers relate to end-March 2005 in

respect of rural co-operatives and end-June 2006 in respect on NBFCs.

Source: Report on Trend and Progress of Banking in India, 2005-06, Reserve Bank of India.

Scheduled commercial banks constitute the predominant segment of the credit market in India.

In all, 83 scheduled commercial banks were in operation at end-March 2006. The commercial

banking sector is undergoing a phase of consolidation. There have been 12 mergers/

amalgamations since 1999. The RRBs, which were set up in the 1970s to provide agricultural and

rural credit, are being restructured at the initiative of the Government of India. Till October 31,

2006, 137 RRBs were amalgamated to form 43 new RRBs, bringing down the total number of

RRBs in the country to 102 from 196 at end-March 2005.

The co-operative banking system, with two broad segments of urban and rural co-operatives,

forms an integral part of the Indian financial system. Urban cooperative banks, also referred to

as primary cooperative banks, play an important role in meeting the growing credit needs of

urban and semi-urban areas of the country. The UCBs, which grew rapidly in the early 1990s,

showed certain weaknesses arising out of lack of sound corporate governance, unethical lending,

comparatively high levels of non-performing loans and their inability to operate in a liberalised

environment. Accordingly, some of the weak UCBs have been either liquidated or merged with

other banks. As a result, the number of UCBs declined from 1,942 at end-March 2001 to 1,853 by

end-March 2006.

Historically, rural co-operative credit institutions have played an important role in providing

institutional credit to the agricultural and rural sectors. These credit institutions, based on the

nature of their lending operations, have typically been pided into two distinct segments,

commonly known as the Short-term Cooperative Credit Structure (STCCS) and the Long-term

Co-operative Credit Structure (LTCCS). The STCCS, comprising PACS at the village level, DCCBs

at the intermediate level, and the STCBs at the apex level, provide crop and other working

capital loans to farmers and rural artisans primarily for short-term purposes. The LTCCS,

comprising SCARDBs at the State level and PCARDBs at the district or block level, provide

typically medium and long-term loans for making investments in agriculture, rural industries

and, in the recent period, housing. However, the structure of rural co-operative banks is not

LOVELY PROFESSIONAL UNIVERSITY 75