Page 64 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 64

Unit 4: Eurocurrency Markets

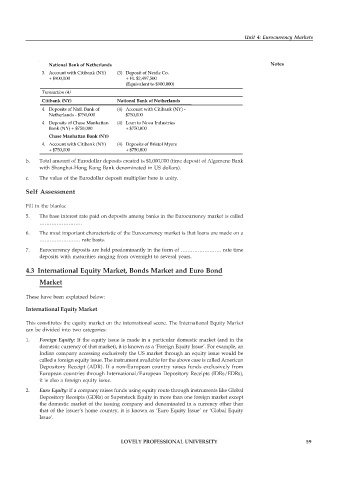

National Bank of Netherlands Notes

3. Account with Citibank (NY) (3) Deposit of Nestle Co.

+ $900,000 + FL $2,497,500

(Equivalent to $900,000)

Transaction (4)

Citibank (NY) National Bank of Netherlands

4. Deposits of Natl. Bank of (4) Account with Citibank (NY) -

Netherlands - $750,000 $750,000

4. Deposits of Chase Manhattan (4) Loan to Nova Industries

Bank (NY) + $750,000 + $750,000

Chase Manhattan Bank (NY)

4. Account with Citibank (NY) (4) Deposits of Bristol Myers

+ $750,000 + $750,000

b. Total amount of Eurodollar deposits created is $1,000,000 (time deposit of Algemene Bank

with Shanghai-Hong Kong Bank denominated in US dollars).

c. The value of the Eurodollar deposit multiplier here is unity.

Self Assessment

Fill in the blanks:

5. The base interest rate paid on deposits among banks in the Eurocurrency market is called

…………………….

6. The most important characteristic of the Eurocurrency market is that loans are made on a

…………………… rate basis.

7. Eurocurrency deposits are held predominantly in the form of …………………… rate time

deposits with maturities ranging from overnight to several years.

4.3 International Equity Market, Bonds Market and Euro Bond

Market

These have been explained below:

International Equity Market

This constitutes the equity market on the international scene. The International Equity Market

can be divided into two categories:

1. Foreign Equity: If the equity issue is made in a particular domestic market (and in the

domestic currency of that market), it is known as a ‘Foreign Equity Issue’. For example, an

Indian company accessing exclusively the US market through an equity issue would be

called a foreign equity issue. The instrument available for the above case is called American

Depository Receipt (ADR). If a non-European country raises funds exclusively from

European countries through International/European Depository Receipts (IDRs/EDRs),

it is also a foreign equity issue.

2. Euro Equity: If a company raises funds using equity route through instruments like Global

Depository Receipts (GDRs) or Superstock Equity in more than one foreign market except

the domestic market of the issuing company and denominated in a currency other than

that of the issuer’s home country, it is known as ‘Euro Equity Issue’ or ‘Global Equity

Issue’.

LOVELY PROFESSIONAL UNIVERSITY 59