Page 247 - DMGT207_MANAGEMENT_OF_FINANCES

P. 247

Management of Finances

Notes 5. Overdraft: Under this facility, customers are allowed to withdraw in excess of credit

advance standing to their current deposit account. A fixed amount is therefore granted to

the borrower within which the borrower is allowed to overdraw his account.

6. Clean overdrafts: Request for clean advances is entertained only from parties, which are

financially sound and reputed for their integrity. The bank has to rely upon the personal

security of the borrowers.

7. Cash credits: Cash credit is an arrangement under which a customer is allowed to draw

advance up to a certain limit against credit granted by bank. Generally, the limits are

sanctioned against the security of goods by way of pledge or hypothecation. Though these

accounts are repayable on demand, banks usually do not recall.

8. Bills purchased/discounted: Advances are allowed against the security of bills, which may

be clean or documentary. Bills are sometimes purchased from approved customers in

whose favour limits are sanctioned. Before granting a limit, the banker satisfies himself as

to the credit worthiness of the drawer.

9. Advance against documents of title to goods: A document becomes a document of title to

goods when its possession is recognized by law or business custom as possession of the

goods. These documents include a bill of lading, dock warehouse keeper's certificate,

railway receipt, etc.,

10. Term loan by banks: Term loan is an installment credit repayable over a period of time in

monthly /quarterly/half yearly or yearly installment. Banks grant term loans for small

projects falling under priority sector, small-scale sector and big units.

11. Commercial paper: It is a form of financing that consists of short-term, unsecured promissory

notes issued by firms with a high credit standing. Most commercial papers have maturity

ranging from 3 months to 6 months and denomination of minimum 5 lakhs.

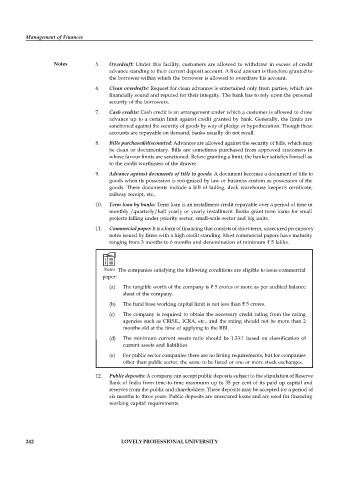

Notes The companies satisfying the following conditions are eligible to issue commercial

paper:

(a) The tangible worth of the company is 5 crores or more as per audited balance

sheet of the company.

(b) The fund base working capital limit is not less than 5 crores.

(c) The company is required to obtain the necessary credit rating from the rating

agencies such as CRISIL, ICRA, etc., and the rating should not be more than 2

months old at the time of applying to the RBI.

(d) The minimum current assets ratio should be 1.33:1 based on classification of

current assets and liabilities.

(e) For public sector companies there are no listing requirements, but for companies

other than public sector, the same to be listed or one or more stock exchanges.

12. Public deposits: A company can accept public deposits subject to the stipulation of Reserve

Bank of India from time-to-time maximum up to 35 per cent of its paid up capital and

reserves from the public and shareholders. These deposits may be accepted for a period of

six months to three years. Public deposits are unsecured loans and are used for financing

working capital requirements.

242 LOVELY PROFESSIONAL UNIVERSITY