Page 243 - DMGT207_MANAGEMENT_OF_FINANCES

P. 243

Management of Finances

Notes

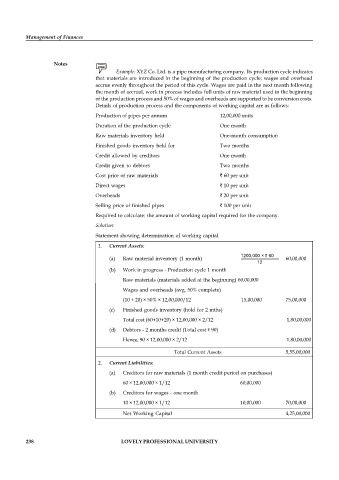

Example: XYZ Co. Ltd. is a pipe manufacturing company. Its production cycle indicates

that materials are introduced in the beginning of the production cycle; wages and overhead

accrue evenly throughout the period of this cycle. Wages are paid in the next month following

the month of accrual, work in process includes full units of raw material used in the beginning

of the production process and 50% of wages and overheads are supported to be conversion costs.

Details of production process and the components of working capital are as follows:

Production of pipes per annum 12,00,000 units

Duration of the production cycle One month

Raw materials inventory held One-month consumption

Finished goods inventory held for Two months

Credit allowed by creditors One month

Credit given to debtors Two months

Cost price of raw materials 60 per unit

Direct wages 10 per unit

Overheads 20 per unit

Selling price of finished pipes 100 per unit

Required to calculate: the amount of working capital required for the company.

Solution:

Statement showing determination of working capital

1. Current Assets:

1200,000 × 60

(a) Raw material inventory (1 month) 60,00,000

12

(b) Work in progress - Production cycle 1 month

Raw materials (materials added at the beginning) 60,00,000

Wages and overheads (avg. 50% complete)

(10 + 20) × 50% × 12,00,000/12 15,00,000 75,00,000

(c) Finished goods inventory (hold for 2 mths)

Total cost (60+10+20) × 12,00,000 × 2/12 1,80,00,000

(d) Debtors - 2 months credit (Total cost 90)

Hence, 90 × 12,00,000 × 2/12 1,80,00,000

Total Current Assets 5,55,00,000

2. Current Liabilities:

(a) Creditors for raw materials (1 month credit period on purchases)

60 × 12,00,000 × 1/12 60,00,000

(b) Creditors for wages - one month

10 × 12,00,000 × 1/12 10,00,000 70,00,000

Net Working Capital 4,25,00,000

238 LOVELY PROFESSIONAL UNIVERSITY