Page 289 - DMGT207_MANAGEMENT_OF_FINANCES

P. 289

Management of Finances

Notes even less creditworthy customers, resulting in longer period to pay over dues. The reverse will

happen if credit standards are tightened.

Further, changing credit standards can also be expected to change the volume of sales. As

standards are relaxed, sales are expected to increase; conversely a tightening is expected to cause

a decline in sales.

!

Caution It must be kept in mind that with relaxation in credit standards, bad expenses will

go up.

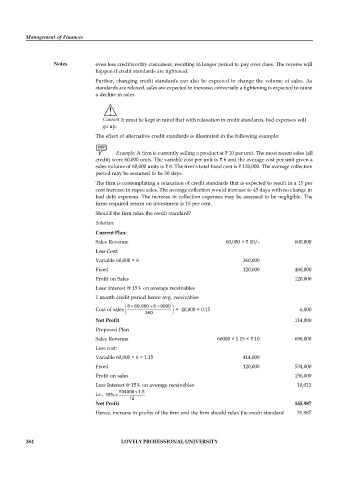

The effect of alternative credit standards is illustrated in the following example:

Example: A firm is currently selling a product at 10 per unit. The most recent sales (all

credit) were 60,000 units. The variable cost per unit is 6 and the average cost per unit given a

sales volume of 60,000 units is 8. The firm’s total fixed cost is 120,000. The average collection

period may be assumed to be 30 days.

The firm is contemplating a relaxation of credit standards that is expected to result in a 15 per

cent increase in rupee sales. The average collection would increase to 45 days with no change in

bad debt expenses. The increase in collection expenses may be assessed to be negligible. The

firms required return on investment is 15 per cent.

Should the firm relax the credit standard?

Solution:

Current Plan:

Sales Revenue 60,000 × 10/- 600,000

Less Cost:

Variable 60,000 × 6 360,000

Fixed 120,000 480,000

Profit on Sales 120,000

Less: Interest @ 15% on average receivables

1 month credit period hence avg. receivables

8 60,000 9000

6

Cost of sales 360 = 40,000 × 0.15 6,000

Net Profit 114,000

Proposed Plan

Sales Revenue 60000 × 1.15 × 10 690,000

Less cost:

Variable 60,000 × 6 × 1.15 414,000

Fixed 120,000 534,000

Profit on sales 156,000

Less Interest @ 15% on average receivables 10,013

i.e., 15% 534000 1.5

12

Net Profit 145,987

Hence, increase in profits of the firm and the firm should relax the credit standard 31,987

284 LOVELY PROFESSIONAL UNIVERSITY