Page 291 - DMGT207_MANAGEMENT_OF_FINANCES

P. 291

Management of Finances

Notes The cash discount has implications for the sales volume, average collection period, bad debt

expenses and profit per unit. The sales volume will increase. The grant of discount implies

reduced prices. If the demand for the products is elastic, reduction in prices will result in higher

sales volume.

!

Caution A firm should determine the credit terms on the basis of cost benefit trade-off.

Since the customers would like to take advantage of the discount and pay within the discount

period, the average collection period would be reduced. The reduction in the collection period

would lead to a reduction in the investment in receivables and also the cost. The decrease in the

average collection period would also cause a fall in bad debt expenses. As a result, profits will

increase. The discount would have a negative effect in the profits. This is because the decrease in

prices would affect the profit margin per unit of sale. Increase in credit period will increase the

sales volume, average collection period and bad debt expenses. A reduction in credit period is

likely to have an opposite effect.

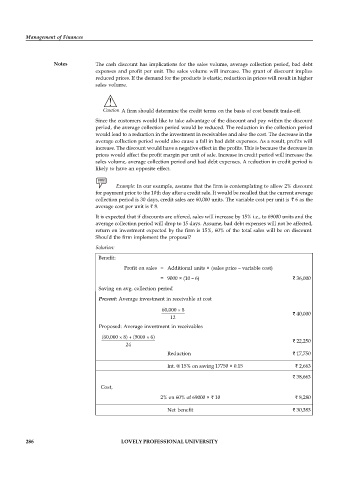

Example: In our example, assume that the firm is contemplating to allow 2% discount

for payment prior to the 10th day after a credit sale. It would be recalled that the current average

collection period is 30 days, credit sales are 60,000 units. The variable cost per unit is 6 as the

average cost per unit is 8.

It is expected that if discounts are offered, sales will increase by 15% i.e., to 69000 units and the

average collection period will drop to 15 days. Assume, bad debt expenses will not be affected,

return on investment expected by the firm is 15%, 60% of the total sales will be on discount.

Should the firm implement the proposal?

Solution:

Benefit:

Profit on sales = Additional units × (sales price – variable cost)

= 9000 × (10 – 6) 36,000

Saving on avg. collection period

Present: Average investment in receivable at cost

40,000

Proposed: Average investment in receivables

22,250

Reduction 17,750

Int. @ 15% on saving 17750 × 0.15 2,663

38,663

Cost,

2% on 60% of 69000 × 10 8,280

Net benefit 30,383

286 LOVELY PROFESSIONAL UNIVERSITY