Page 271 - DECO502_INDIAN_ECONOMIC_POLICY_ENGLISH

P. 271

Unit 21: Capital Market in India and Working of SEBI

As the Central and State Governments are investing not only on economic overheads as transport, Notes

irrigation and power development but also on basic industries and sometimes even consumer goods

industries, they require substantial sums from the capital market.

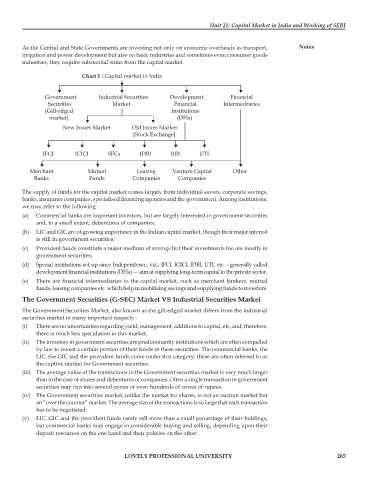

Chart 1 : Capital market in India

Government Industrial Securities Development Financial

Securities Market Financial Intermedraries

(Gill-edged Institutions

market) (DFIs)

New Issues Market Old Issues Market

[Stock Exchange]

IFCI ICICI SFCs IDBI IIBI UTI

Merchant Mutual Leasing Venture Capital Other

Banks Funds Companies Companies

The supply of funds for the capital market comes largely from individual savers, corporate savings,

banks, insurance companies, specialised financing agencies and the government. Among institutions,

we may refer to the following :

(a) Commercial banks are important investors, but are largely interested in government securities

and, to a small extent, debentures of companies;

(b) LIC and GIC are of growing importance in the Indian capital market, though their major interest

is still in government securities;

(c) Provident funds constitute a major medium of savings but their investments too are mostly in

government securities;

(d) Special institutions set up since Independence, viz., IFCI, ICICI, IDBI, UTI, etc. - generally called

development financial institutions (DFIs) — aim at supplying long-term capital to the private sector.

(e) There are financial intermediaries in the capital market, such as merchant bankers, mutual

funds, leasing companies etc. which help in mobilising savings and supplying funds to investors.

The Government Securities (G-SEC) Market VS Industrial Securities Market

The Government Securities Market, also known as the gilt-edged market differs from the industrial

securities market in many important respects :

(i) There are no uncertainties regarding yield, management, additions to capital, etc, and, therefore,

there is much less speculation in this market.

(ii) The investors in government securities are predominantly institutions which are often compelled

by law to invest a certain portion of their funds in these securities. The commercial banks, the

LIC, the GIC and the provident funds come under this category; these are often referred to as

the captive market for Government securities.

(iii) The average value of the transactions in the Government securities market is very much larger

than in the case of shares and debentures of companies. Often a single transaction in government

securities may run into several crores or even hundreds of crores of rupees.

(iv) The Government securities market, unlike the market for shares, is not an auction market but

an “over the counter” market. The average size of the transactions is so large that each transaction

has to be negotiated.

(v) LIC, GIC and the provident funds rarely sell more than a small percentage of their holdings,

but commercial banks may engage in considerable buying and selling, depending upon their

deposit resources on the one hand and their policies on the other.

LOVELY PROFESSIONAL UNIVERSITY 265