Page 147 - DECO503_INTERNATIONAL_TRADE_AND_FINANCE_ENGLISH

P. 147

Unit 12 : Equilibrium and Disequilibrium in BOP

Without growth in the domestic source component, the stock of foreign exchange reserves would Notes

grow without limit as the countrys income and demand for money grows. This growth of

reserves must be controlled because short-term foreign government securities, the main assets

held as official reserves, are not a particularly good form for a country to hold large quantities

of its wealth. Given the countrys employed capital stock and the amount of wealth its residents

possess, the bigger the fraction of that wealth held in the form of short-term foreign assets, the

smaller will be the fraction held in equity and fixed income claims against domestically employed

capital which will yield much higher returns than the treasury bills that form the greater part of

the stock of official foreign exchange reserves.

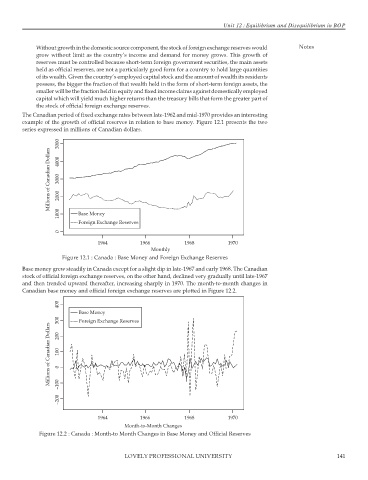

The Canadian period of fixed exchange rates between late-1962 and mid-1970 provides an interesting

example of the growth of official reserves in relation to base money. Figure 12.1 presents the two

series expressed in millions of Canadian dollars.

5000

Millions of Canadian Dollars 4000 3000 2000

1000 Base Money

Foreign Exchange Reserves

0

1964 1966 1968 1970

Monthly

Figure 12.1 : Canada : Base Money and Foreign Exchange Reserves

Base money grew steadily in Canada except for a slight dip in late-1967 and early 1968. The Canadian

stock of official foreign exchange reserves, on the other hand, declined very gradually until late-1967

and then trended upward thereafter, increasing sharply in 1970. The month-to-month changes in

Canadian base money and official foreign exchange reserves are plotted in Figure 12.2.

400

Base Money

300 200 Foreign Exchange Reserves

Millions of Canadian Dollars 100 0

–200 –100

1964 1966 1968 1970

Month-to-Month Changes

Figure 12.2 : Canada : Month-to Month Changes in Base Money and Official Reserves

LOVELY PROFESSIONAL UNIVERSITY 141