Page 148 - DECO503_INTERNATIONAL_TRADE_AND_FINANCE_ENGLISH

P. 148

International Trade and Finance

Notes The month-to-month changes in official foreign exchange reserves were much more variable than

the month to month changes in base money, particularly in 1968, and reserves grew very sharply in

early 1970. How do we explain this ?

The fact that reserves were more variable than base money suggests that these changes in official

reserves were driven in considerable part by changes in the opposite direction in the domestic source

component. Since H equals R plus Dsc , greater variability of R than H can only result from variability

of Dsc in the opposite directions. An ordinary least squares regression of the month-to-month changes

in foreign exchange reserves on the month-to-month changes in base money indicates no statistically

significant relationship between them. The slope coefficient is negative with a P-Value of .23 ---

indicating a 23 percent chance of observing a negative value of the magnitude observed purely on the

basis of random chance when the true value is in fact zero---and the R-Square is only .01.

We have to conclude that much of the variability of the stock of official reserves was the result of the

Bank of Canadas manipulation of the domestic source component but we should not venture a

conclusion as to why the Bank was doing this without much more careful study. It is well-known

that the Canadian Government abandoned the fixed exchange rate in mid-1970 in order to allow the

government to control increasing upward domestic inflationary pressure which it was powerless to

control under a fixed exchange rate. Accordingly, the observed escalating increases in the stock of

official reserves in 1970 may well be the result of a fruitless attempt by the Bank of Canada to get a

handle on domestic inflation by reducing the growth of the domestic source component of high-

powered money. The only way to get control was to let the Canadian dollar float freely in the

international market---only then could monetary policy become effective.

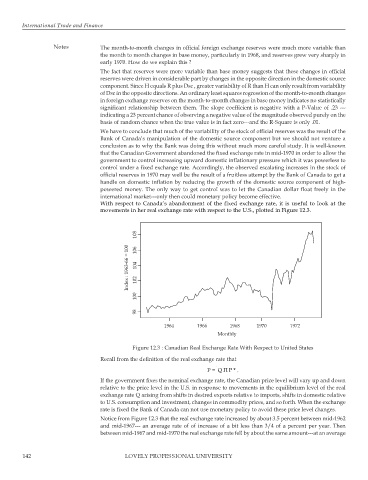

With respect to Canadas abandonment of the fixed exchange rate, it is useful to look at the

movements in her real exchange rate with respect to the U.S., plotted in Figure 12.3.

108 106

Index : 1963-66 = 100 104 102

100

98

1964 1966 1968 1970 1972

Monthly

Figure 12.3 : Canadian Real Exchange Rate With Respect to United States

Recall from the definition of the real exchange rate that

P = Q П P* .

If the government fixes the nominal exchange rate, the Canadian price level will vary up and down

relative to the price level in the U.S. in response to movements in the equilibrium level of the real

exchange rate Q arising from shifts in desired exports relative to imports, shifts in domestic relative

to U.S. consumption and investment, changes in commodity prices, and so forth. When the exchange

rate is fixed the Bank of Canada can not use monetary policy to avoid these price level changes.

Notice from Figure 12.3 that the real exchange rate increased by about 3.5 percent between mid-1962

and mid-1967--- an average rate of of increase of a bit less than 3/4 of a percent per year. Then

between mid-1967 and mid-1970 the real exchange rate fell by about the same amount---at an average

142 LOVELY PROFESSIONAL UNIVERSITY