Page 374 - DECO503_INTERNATIONAL_TRADE_AND_FINANCE_ENGLISH

P. 374

International Trade and Finance

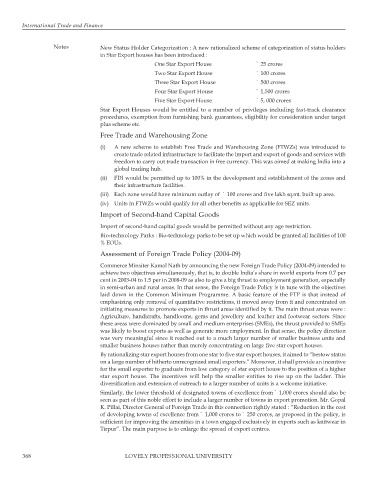

Notes New Status Holder Categorization : A new rationalized scheme of categorization of status holders

in Star Export houses has been introduced :

One Star Export House ` 25 crores

Two Star Export House ` 100 crores

Three Star Export House ` 500 crores

Four Star Export House ` 1,500 crores

Five Star Export House ` 5, 000 crores

Star Export Houses would be entitled to a number of privileges including fast-track clearance

procedures, exemption from furnishing bank guarantees, eligibility for consideration under target

plus scheme etc.

Free Trade and Warehousing Zone

(i) A new scheme to establish Free Trade and Warehousing Zone (FTWZs) was introduced to

create trade related infrastructure to facilitate the import and export of goods and services with

freedom to carry out trade transaction in free currency. This was aimed at making India into a

global trading hub.

(ii) FDI would be permitted up to 100% in the development and establishment of the zones and

their infrastructure facilities.

(iii) Each zone would have minimum outlay of ` 100 crores and five lakh sq.mt. built up area.

(iv) Units in FTWZs would qualify for all other benefits as applicable for SEZ units.

Import of Second-hand Capital Goods

Import of second-hand capital goods would be permitted without any age restriction.

Bio-technology Parks : Bio-technology parks to be set up which would be granted all facilities of 100

% EOUs.

Assessment of Foreign Trade Policy (2004-09)

Commerce Minsiter Kamal Nath by announcing the new Foreign Trade Policy (2004-09) intended to

achieve two objectives simultaneously, that is, to double India’s share in world exports from 0.7 per

cent in 2003-04 to 1.5 per in 2008-09 as also to give a big thrust to employment generation, especially

in semi-urban and rural areas. In that sense, the Foreign Trade Policy is in tune with the objectives

laid down in the Common Minimum Programme. A basic feature of the FTP is that instead of

emphasizing only removal of quantitative restrictions, it moved away from it and concentrated on

initiating measures to promote exports in thrust areas identified by it. The main thrust areas were :

Agriculture, handicrafts, handlooms, gems and jewellery and leather and footwear sectors. Since

these areas were dominated by small and medium enterprises (SMEs), the thrust provided to SMEs

was likely to boost exports as well as generate more employment. In that sense, the policy direction

was very meaningful since it reached out to a much larger number of smaller business units and

smaller business houses rather than merely concentrating on large five star export houses.

By rationalizing star export houses from one star to five star export houses, it aimed to “bestow status

on a large number of hitherto unrecognized small exporters.” Moreover, it shall provide an incentive

for the small exporter to graduate from low category of star export house to the position of a higher

star export house. The incentives will help the smaller entities to rise up on the ladder. This

diversification and extension of outreach to a larger number of units is a welcome initiative.

Similarly, the lower threshold of designated towns of excellence from ` 1,000 crores should also be

seen as part of this noble effort to include a larger number of towns in export promotion. Mr. Gopal

K. Pillai, Director General of Foreign Trade in this connection rightly stated : “Reduction in the cost

of developing towns of excellence from ` 1,000 crores to ` 250 crores, as proposed in the policy, is

sufficient for improving the amenities in a town engaged exclusively in exports such as knitwear in

Tirpur”. The main purpose is to enlarge the spread of export centres.

368 LOVELY PROFESSIONAL UNIVERSITY